Question: Smith Computing, Inc. performed a transactional analysis to determine the effects of the transactions on their accounting equation. (Click the icon to view the completed

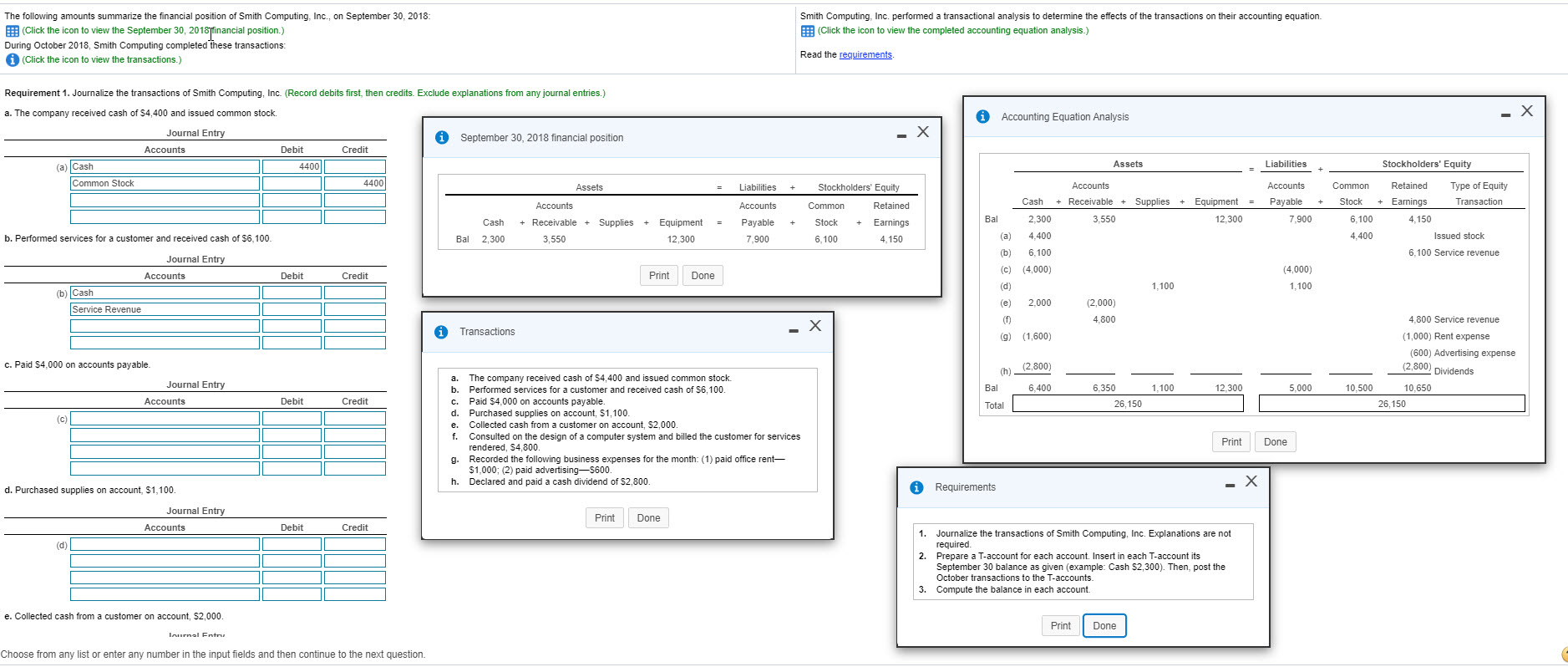

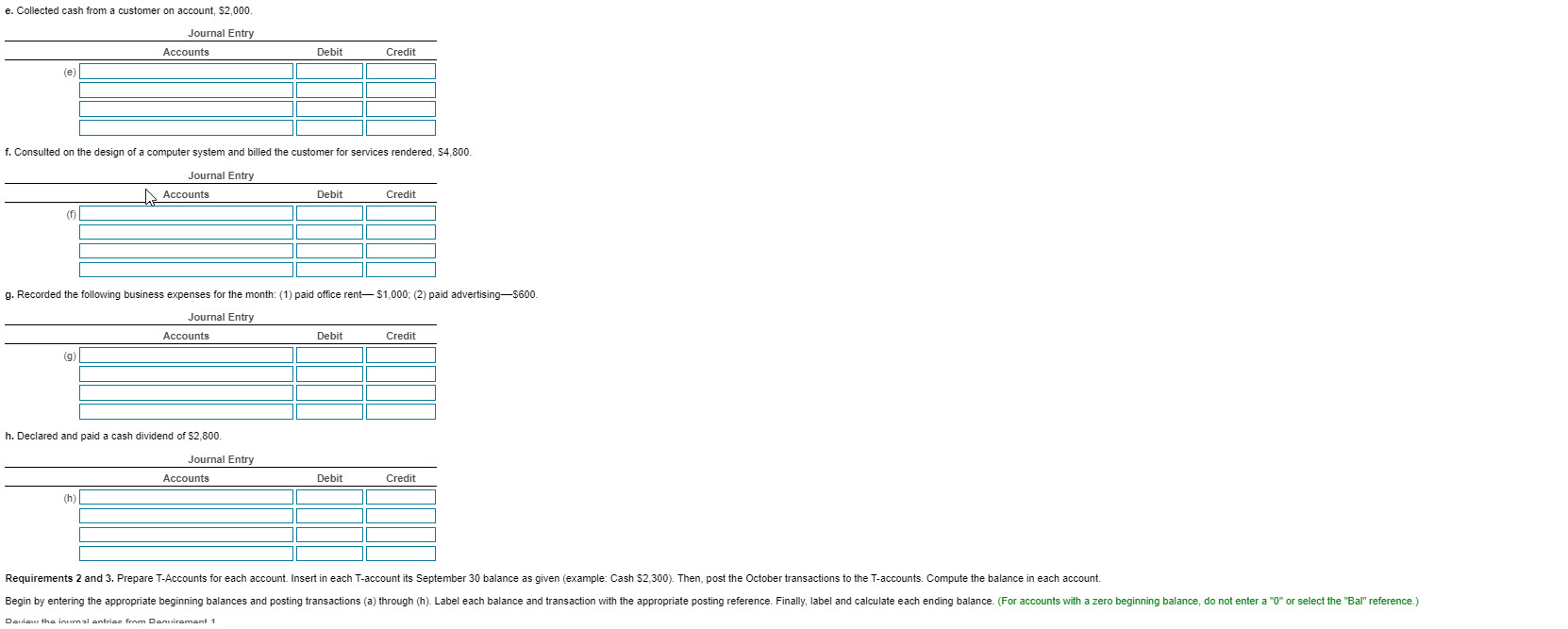

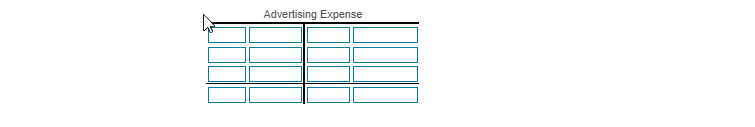

Smith Computing, Inc. performed a transactional analysis to determine the effects of the transactions on their accounting equation. (Click the icon to view the completed accounting equation analysis.) The following amounts summarize the financial position of Smith Computing, Inc., on September 30, 2018: (Click the icon to view the September 30, 2018|financial position.) During October 2018, Smith Computing completed these transactions: (Click the icon to view the transactions.) Read the requirements 0 Accounting Equation Analysis Requirement 1. Journalize the transactions of Smith Computing, Inc. (Record debits first, then credits. Exclude explanations from any journal entries.) a. The company received cash of $4,400 and issued common stock. Journal Entry 0 September 30, 2018 financial position Accounts Debit Credit (a) Cash Common Stock Assets Assets Liabilities Stockholders' Equity = + Accounts + Receivable + Common Stock Supplies + Liabilities Accounts Payable 7,900 Accounts + Receivable + 3,550 Stockholders' Equity Common Retained Stock + Earnings 6,100 4,150 Accounts Payable 7,900 + Equipment = 12,300 = + 3,550 Cash 2,300 Supplies - Equipment 12,300 6,100 4,400 Retained Type of Equity + Earnings Transaction 4.150 Issued stock 6,100 Service revenue Cash Bal 2.300 (a) 4.400 (b) 6,100 (c) (4,000) b. Performed services for a customer and received cash of $6,100. Bal Journal Entry Accounts Debit Credit Print Done (4,000) 1.100 1,100 (b) Cash (e) 2,000 Service Revenue (2.000) 4.800 X i Transactions (g) (1,600) 4.800 Service revenue (1,000) Rent expense (600) Advertising expense c. Paid $4,000 on accounts payable. (h) _(2,800) (2,800) Dividends Journal Entry 6,400 1,100 12.300 10,500 Bal Total 10,650 26,150 Debit 6,350 26,150 Accounts Credit a. The company received cash of $4,400 and issued common stock. b. Performed services for a customer and received cash of S6, 100. c. Paid $4.000 on accounts payable. d. Purchased supplies on account, $1,100. e. Collected cash from a customer on account, $2,000. f. Consulted on the design of a computer system and billed the customer for services rendered, $4,800. g. Recorded the following business expenses for the month: (1) paid office rent- $1,000; (2) paid advertisingS600. h. Declared and paid a cash dividend of $2,800. Print Done d. Purchased supplies on account, $1,100. * Requirements Journal Entry Print Done Accounts Debit Credit 1. Journalize the transactions of Smith Computing, Inc. Explanations are not required. 2. Prepare a T-account for each account. Insert in each T-account its September 30 balance as given (example: Cash $2,300). Then, post the October transactions to the T-accounts. 3. Compute the balance in each account. e. Collected cash from a customer on account, $2,000. Print Done lurnal Entru Choose from any list or enter any number in the input fields and then continue to the next question. e. Collected cash from a customer on account, $2,000. Journal Entry Accounts Debit Credit f. Consulted on the design of a computer system and billed the customer for services rendered, S4,800 Journal Entry Accounts Debit Credit g. Recorded the following business expenses for the month: (1) paid office rent- $1,000; (2) paid advertising$600. Journal Entry Accounts Debit Credit h. Declared and paid a cash dividend of $2,800. Journal Entry Accounts Debit Credit Requirements 2 and 3. Prepare T-Accounts for each account. Insert in each T-account its September 30 balance as given (example: Cash $2.300). Then, post the October transactions to the T-accounts. Compute the balance in each account. Begin by entering the appropriate beginning balances and posting transactions (a) through (h). Label each balance and transaction with the appropriate posting reference. Finally, label and calculate each ending balance. (For accounts with a zero beginning Den the inurnal entries from Denniamant 1 Begin by entering the appropriate beginning balances and posting transactions (a) through (h). Label each balance and transaction with the appropriate posting reference. Finally, label and calculate each ending balance. (For accounts with a zero beginning balance, do not enter a "0" or select the "Bal" reference.) Review the journal entries from Requirement 1. Cash Common Stock Accounts Receivable Retained Earnings Supplies Dividends Equipment Service Revenue Accounts Payable Rent Expense BA Advertising Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts