Question: so I already have the table filled out. My issue is I don't understand what MARR to assume to compare the two alternatives by FW

so I already have the table filled out. My issue is I don't understand what MARR to assume to compare the two alternatives by FW method. do I just pick any MARR and go with it?

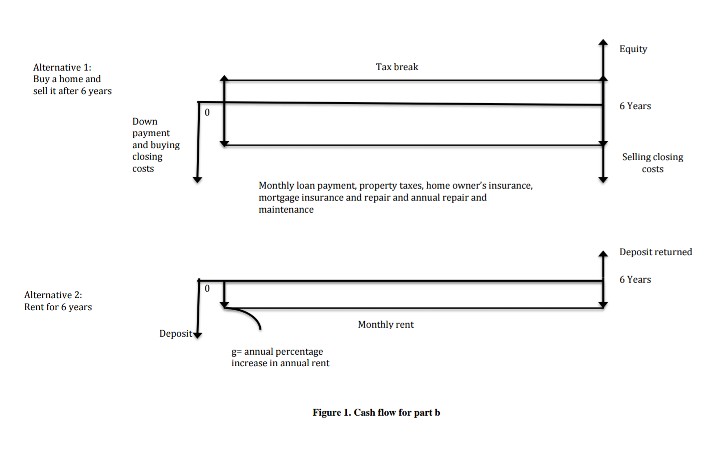

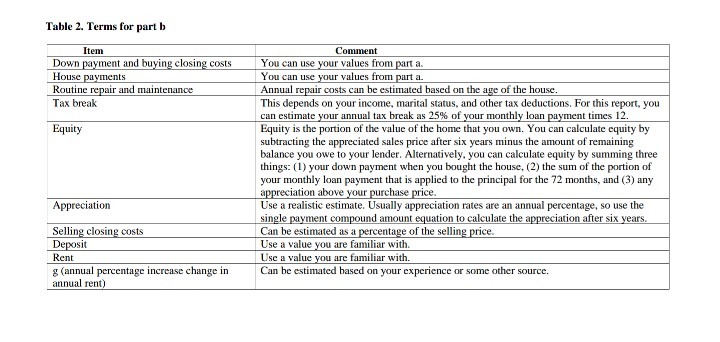

Part b) Deciding to buy or rent Your task Determine if it would be economically better for you to buy a home or rent an apartment. Content Imagine you have decided to stay at the university six more years to do a master's degree and then a PhD. (Don't worry this is fictitious; and besides, on the happy side, we will also imagine you can afford to buy a house ). The question is whether it would be economically better to buy a home and sell it in six years or is it better to just rent an apartment. To work out this problem you will need to make a few assumptions2. Figure 1 shows the cash flow diagram that you will assume for each alternative and Table 2 describes the cash flows. You may choose to include other items, such as utilities, parking fees, association fees, etc. You might even want to think of a dollar value to put on a few non-monetary costs and benefits (see question 4 below Use Future Worth Analysis to compare the two alternatives. Choose your MARR. Assume your MARR is adjusted for inflation. Show your estimates for all the items in Table 2. In your report, include sources and assumptions Also, answer these questions: 1. Based only on future worth analysis, which alternative should you choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts