Question: So I did part (a) 2 ways, with the correct answer being $1116.41. Can someone explain why the selected box is a different answer? I

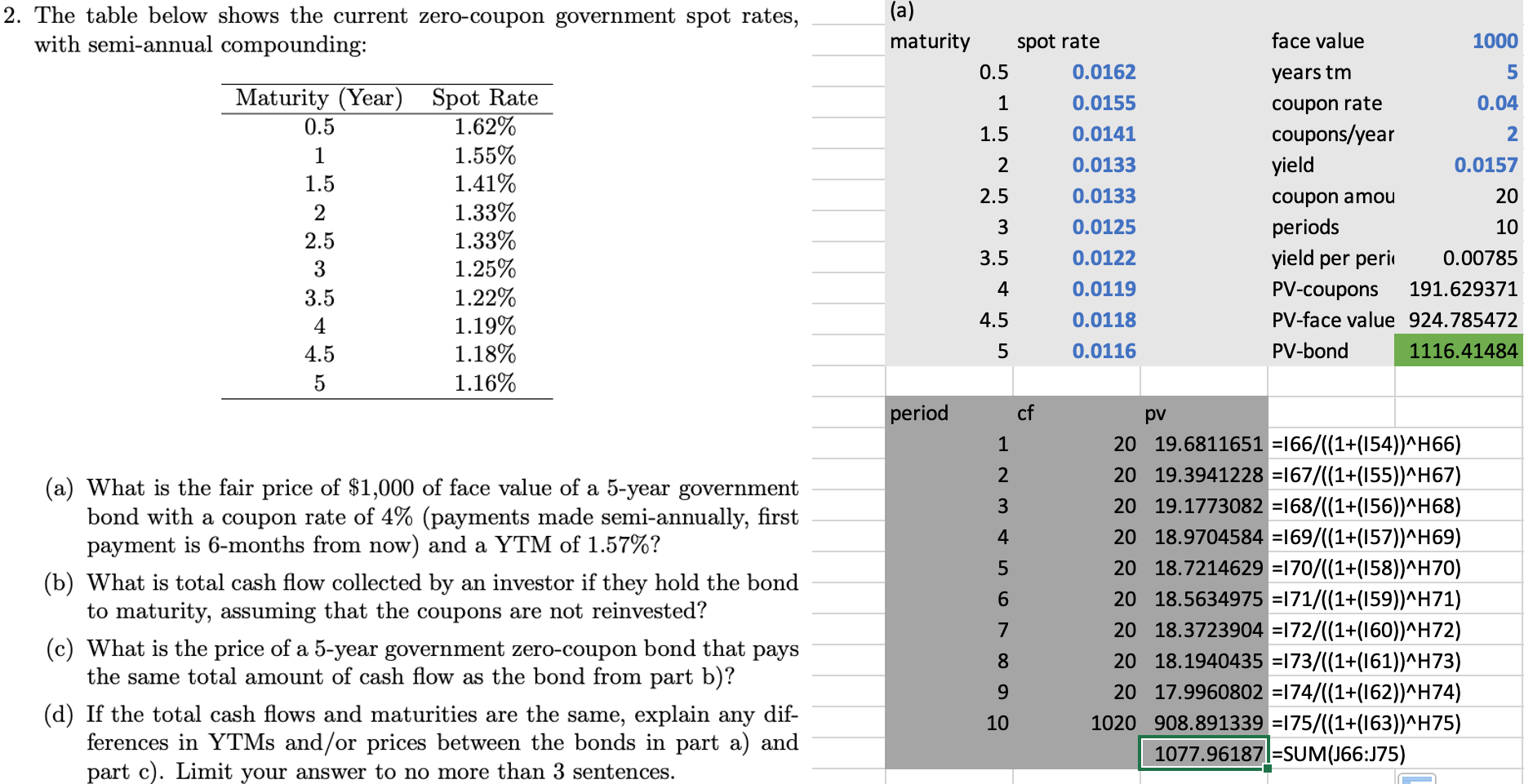

So I did part (a) 2 ways, with the correct answer being $1116.41. Can someone explain why the selected box is a different answer? I discounted each cash flow using the appropriate spot rate.

2. The table below shows the current zero-coupon government spot rates, with semi-annual compounding: Maturity (Year) Spot Rate 0.5 1.62% 1 1.55% 1.5 1.41% 2 1.33% 2.5 1.33% 3 1.25% 3.5 1.22% 4 1.19% 4.5 1.18% 5 1.16% (a) maturity spot rate 0.5 0.0162 1 0.0155 1.5 0.0141 2 0.0133 2.5 0.0133 3 0.0125 3.5 0.0122 4 0.0119 4.5 0.0118 5 0.0116 face value 1000 years tm 5 coupon rate 0.04 coupons/year 2 yield 0.0157 coupon amou 20 periods 10 yield per perio 0.00785 PV-coupons 191.629371 PV-face value 924.785472 PV-bond 1116.41484 period cf 1 2 3 4 5 pv 20 19.6811651 =166/((1+(154))^H66) 20 19.3941228 =167/((1+(155))^H67) 20 19.1773082 =168/((1+(156))^H68) 20 18.9704584 =169/((1+(157))^H69) 20 18.7214629 =170/((1+(158))^H70) 20 18.5634975 =171/((1+(159))^H71) 20 18.3723904 =172/((1+(160))^H72) 20 18.1940435 =173/((1+(161))^H73) 20 17.9960802 =174/((1+(162))^H74) 1020908.891339 =175/((1+(163))^H75) 1077.961871=SUM(J66:175) (a) What is the fair price of $1,000 of face value of a 5-year government bond with a coupon rate of 4% (payments made semi-annually, first payment is 6-months from now) and a YTM of 1.57%? (b) What is total cash flow collected by an investor if they hold the bond to maturity, assuming that the coupons are not reinvested? (c) What is the price of a 5-year government zero-coupon bond that pays the same total amount of cash flow as the bond from part b)? (d) If the total cash flows and maturities are the same, explain any dif- ferences in YTMs and/or prices between the bonds in part a) and part c). Limit your answer to no more than 3 sentences. 6 7 8 9 10 2. The table below shows the current zero-coupon government spot rates, with semi-annual compounding: Maturity (Year) Spot Rate 0.5 1.62% 1 1.55% 1.5 1.41% 2 1.33% 2.5 1.33% 3 1.25% 3.5 1.22% 4 1.19% 4.5 1.18% 5 1.16% (a) maturity spot rate 0.5 0.0162 1 0.0155 1.5 0.0141 2 0.0133 2.5 0.0133 3 0.0125 3.5 0.0122 4 0.0119 4.5 0.0118 5 0.0116 face value 1000 years tm 5 coupon rate 0.04 coupons/year 2 yield 0.0157 coupon amou 20 periods 10 yield per perio 0.00785 PV-coupons 191.629371 PV-face value 924.785472 PV-bond 1116.41484 period cf 1 2 3 4 5 pv 20 19.6811651 =166/((1+(154))^H66) 20 19.3941228 =167/((1+(155))^H67) 20 19.1773082 =168/((1+(156))^H68) 20 18.9704584 =169/((1+(157))^H69) 20 18.7214629 =170/((1+(158))^H70) 20 18.5634975 =171/((1+(159))^H71) 20 18.3723904 =172/((1+(160))^H72) 20 18.1940435 =173/((1+(161))^H73) 20 17.9960802 =174/((1+(162))^H74) 1020908.891339 =175/((1+(163))^H75) 1077.961871=SUM(J66:175) (a) What is the fair price of $1,000 of face value of a 5-year government bond with a coupon rate of 4% (payments made semi-annually, first payment is 6-months from now) and a YTM of 1.57%? (b) What is total cash flow collected by an investor if they hold the bond to maturity, assuming that the coupons are not reinvested? (c) What is the price of a 5-year government zero-coupon bond that pays the same total amount of cash flow as the bond from part b)? (d) If the total cash flows and maturities are the same, explain any dif- ferences in YTMs and/or prices between the bonds in part a) and part c). Limit your answer to no more than 3 sentences. 6 7 8 9 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts