Question: Solar Tech Inc. must choose between two mutually exclusive projects: A and B. Both have a 10% required rate of return. Consider the following

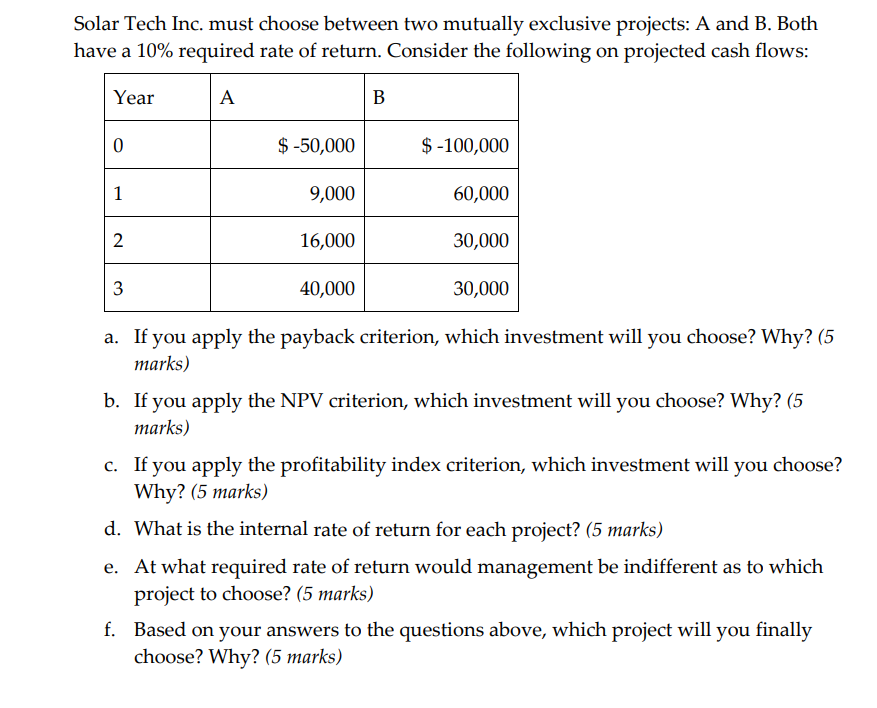

Solar Tech Inc. must choose between two mutually exclusive projects: A and B. Both have a 10% required rate of return. Consider the following on projected cash flows: Year A 0 1 2 3 $-50,000 9,000 16,000 40,000 B $ -100,000 60,000 30,000 30,000 a. If you apply the payback criterion, which investment will you choose? Why? (5 marks) b. If you apply the NPV criterion, which investment will you choose? Why? (5 marks) c. If you apply the profitability index criterion, which investment will you choose? Why? (5 marks) d. What is the internal rate of return for each project? (5 marks) e. At what required rate of return would management be indifferent as to which project to choose? (5 marks) f. Based on your answers to the questions above, which project will you finally choose? Why? (5 marks)

Step by Step Solution

There are 3 Steps involved in it

a The payback criterion measures the length of time required for an investment to recover its initial cost To calculate the payback period we accumula... View full answer

Get step-by-step solutions from verified subject matter experts