Question: Solution all question Question 1 (40 marks) A-Habiba Youssef is a Juice merchant trading from a single shop. Here is her trial balance as at

Solution all question

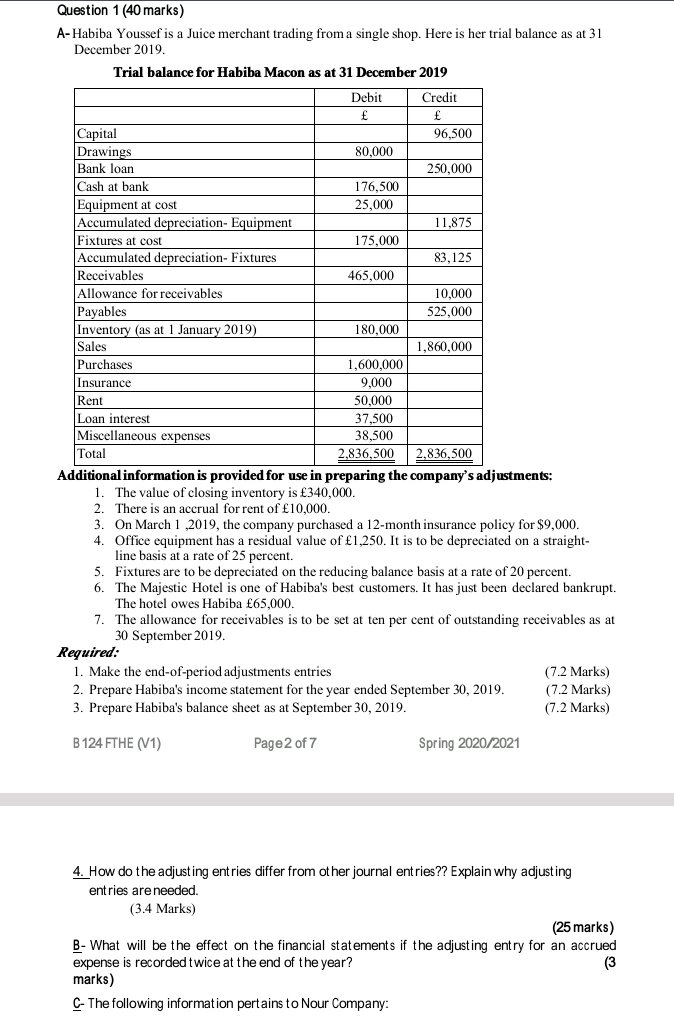

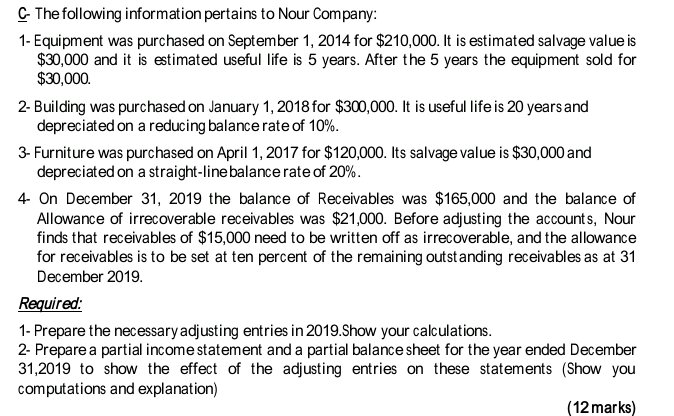

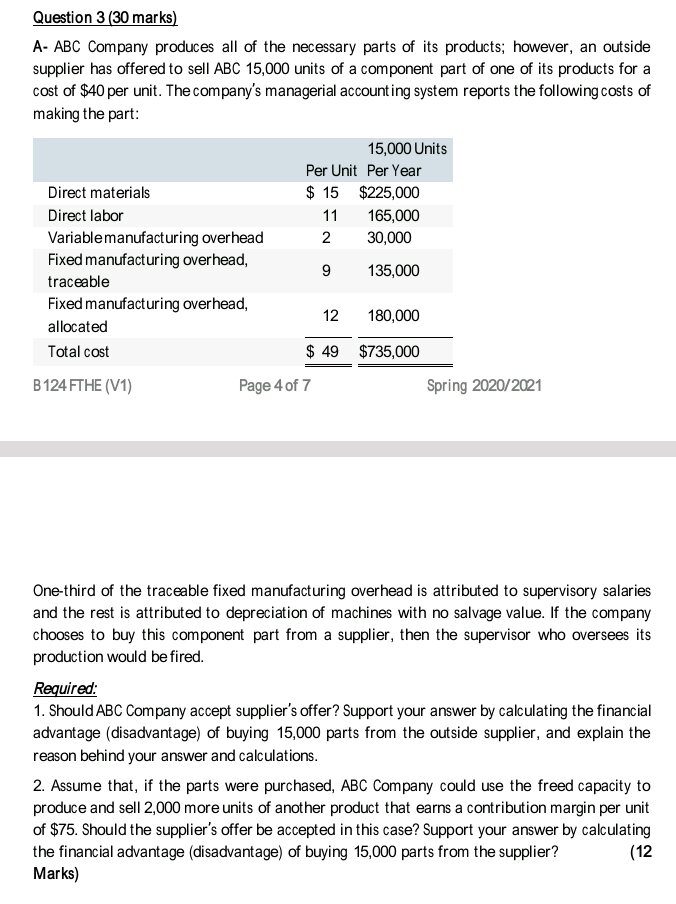

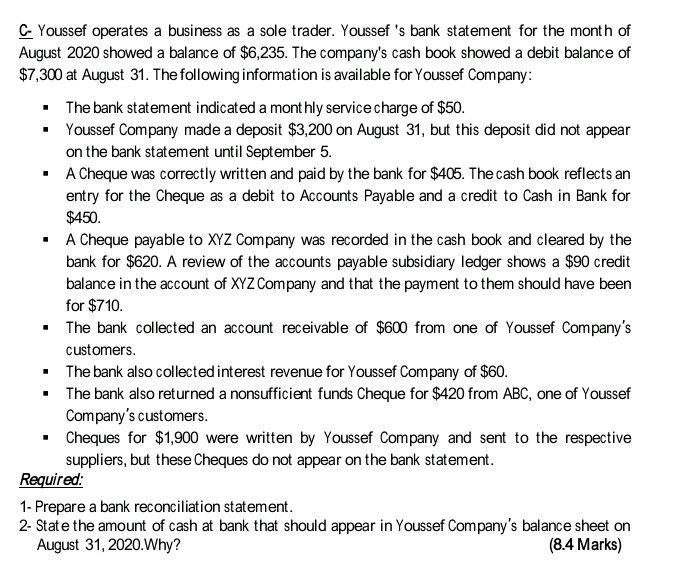

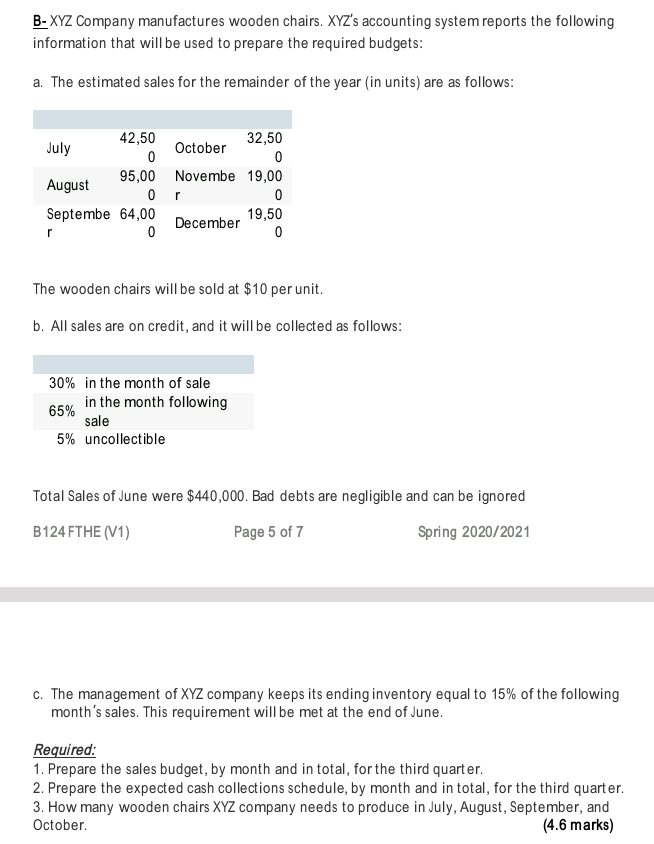

Question 1 (40 marks) A-Habiba Youssef is a Juice merchant trading from a single shop. Here is her trial balance as at 31 December 2019. Trial balance for Habiba Macon as at 31 December 2019 Debit Credit E Capital 96,500 Drawings 80,000 Bank loan 250,000 Cash at bank 176,500 Equipment at cost 25,000 Accumulated depreciation- Equipment 1,875 Fixtures at cost 175,000 Accumulated depreciation- Fixtures 83, 125 Receivables 465,000 Allowance for receivables 0.000 Payables 525,000 Inventory (as at 1 January 2019) 80,000 Sales 1,860,000 Purchases 1,600,000 Insurance 9.000 Ren 50,000 Loan interest 37,500 Miscellaneous expenses 38,500 Total 2,836,500 2.836.500 Additional information is provided for use in preparing the company's adjustments: 1. The value of closing inventory is $340,000. 2. There is an accrual for rent of $10,000. 3. On March 1 ,2019, the company purchased a 12-month insurance policy for $9,000. . Office equipment has a residual value of f1,250. It is to be depreciated on a straight- line basis at a rate of 25 percent. 5. Fixtures are to be depreciated on the reducing balance basis at a rate of 20 percent. 6. The Majestic Hotel is one of Habiba's best customers. It has just been declared bankrupt. The hotel owes Habiba 65,000. 7. The allowance for receivables is to be set at ten per cent of outstanding receivables as at 30 September 2019. Required: 1. Make the end-of-period adjustments entries (7.2 Marks) 2. Prepare Habiba's income statement for the year ended September 30, 2019. (7.2 Marks) 3. Prepare Habiba's balance sheet as at September 30, 2019. (7.2 Marks) B 124 FTHE (V1) Page2 of 7 Spring 2020/2021 4. How do the adjusting entries differ from other journal entries?? Explain why adjusting entries are needed (3.4 Marks) (25 marks) B- What will be the effect on the financial statements if the adjusting entry for an accrued expense is recorded twice at the end of the year? (3 marks) C- The following information pertains to Nour Company:C The following information pertains to Nour Company: 1- Equipment was purchased on September 1, 2014 for $210,000. It is estimated salvage value is $30,000 and it is estimated useful life is 5 years. After the 5 years the equipment sold for $30,000. 2- Building was purchased on January 1, 2018 for $300,000. It is useful life is 20 years and depreciated on a reducing balance rate of 10%. 3- Furniture was purchased on April 1, 2017 for $120,000. Its salvage value is $30,000 and depreciated on a straight-line balance rate of 20%. 4- On December 31, 2019 the balance of Receivables was $165,000 and the balance of Allowance of irrecoverable receivables was $21,000. Before adjusting the accounts, Nour finds that receivables of $15,000 need to be written off as irrecoverable, and the allowance for receivables is to be set at ten percent of the remaining outstanding receivables as at 31 December 2019. Required: 1- Prepare the necessary adjusting entries in 2019.Show your calculations. 2- Prepare a partial income statement and a partial balance sheet for the year ended December 31,2019 to show the effect of the adjusting entries on these statements (Show you computations and explanation) (12 marks)Question 3 30 marks 111- ABC Company produces all of the necessary parts of its products; however, an outside supplier has offered to sell ASS 15,000 units of a component part of one of its products for a cost of $40 per unit. The company's managerial accounting system reports the following costs of making the part: 15,000 Units Per Unit Per ifeer Direct materials $ 15 $225,000 Direct labor 1 1 165,000 'v'ariable manufacturing overhead 2 30,000 Fixed manufact urmg overhead, 9 135: 000 traceable Fixed ma nufact uring overhead, allocated 12 100,000 Total cost $ 45 $735,000 5124 FfHE [W] Page 4of 3\" Spring 2020321121 Cine-third of the traceable fixed manufacturing overhead is attributed to supervisory salaries and the rest is attributed to depreciation of machines with no salvage value. If the company cl'iooses to buy this component part from a supplier, then the supervisor who oversees its production would befired. 'red: 1. Should ASS Company accept supplier's offer? Support your answer by calculating the financial advantage {disadvantage} of buying 15,000 parts from the outside supplier, and explain the reason behind your answer and calculations. 2. Assume that, if the parts were purchased, ASS Company could use the freed capacity to produce and sell 2,000 more units of another product that earns a contribution margin per unit of $75. Should the suppliers offer be accepted in this case'iI Support your answer by calculating the financial advantage [disadvantage] of buying 15,000 parts from the supplier? [12 Marks} C- Youssef operates a business as a sole trader. Youssef 's bank statement for the month of August 2020 showed a balance of $6,235. The company's cash book showed a debit balance of $7,300 at August 31. The following information is available for Youssef Company: The bank statement indicated a monthly service charge of $50. " Youssef Company made a deposit $3,200 on August 31, but this deposit did not appear on the bank statement until September 5. A Cheque was correctly written and paid by the bank for $405. The cash book reflects an entry for the Cheque as a debit to Accounts Payable and a credit to Cash in Bank for $450. A Cheque payable to XYZ Company was recorded in the cash book and cleared by the bank for $620. A review of the accounts payable subsidiary ledger shows a $90 credit balance in the account of XYZ Company and that the payment to them should have been for $710. The bank collected an account receivable of $600 from one of Youssef Company's customers. The bank also collected interest revenue for Youssef Company of $60. The bank also returned a nonsufficient funds Cheque for $420 from ABC, one of Youssef Company's customers. " Cheques for $1,900 were written by Youssef Company and sent to the respective suppliers, but these Cheques do not appear on the bank statement. Required: 1- Prepare a bank reconciliation statement. 2- State the amount of cash at bank that should appear in Youssef Company's balance sheet on August 31, 2020.Why? (8.4 Marks)B- XYZ Company manufactures wooden chairs. XYZ's accounting system reports the following information that will be used to prepare the required budgets: a. The estimated sales for the remainder of the year (in units) are as follows: 42,50 October 32,50 July 0 August 95,00 November 19,00 0 r 0 Septembe 64,00 December 19,50 r 0 0 The wooden chairs will be sold at $10 per unit. b. All sales are on credit, and it will be collected as follows: 30% in the month of sale 65% in the month following sale 5% uncollectible Total Sales of June were $440,000. Bad debts are negligible and can be ignored B124 FTHE (V1) Page 5 of 7 Spring 2020/2021 c. The management of XYZ company keeps its ending inventory equal to 15% of the following month's sales. This requirement will be met at the end of June. Required: 1. Prepare the sales budget, by month and in total, for the third quarter. 2. Prepare the expected cash collections schedule, by month and in total, for the third quarter. 3. How many wooden chairs XYZ company needs to produce in July, August, September, and October. (4.6 marks)