Question: Solution below: Can someone explain the solution above. I have trouble understanding why we have to times the updated depreciation by 0.1. I know the

Solution below:

Solution below:

Can someone explain the solution above. I have trouble understanding why we have to times the updated depreciation by 0.1. I know the bike depreciates according to kilometers driven each year. But is still don't understand the 0.1.

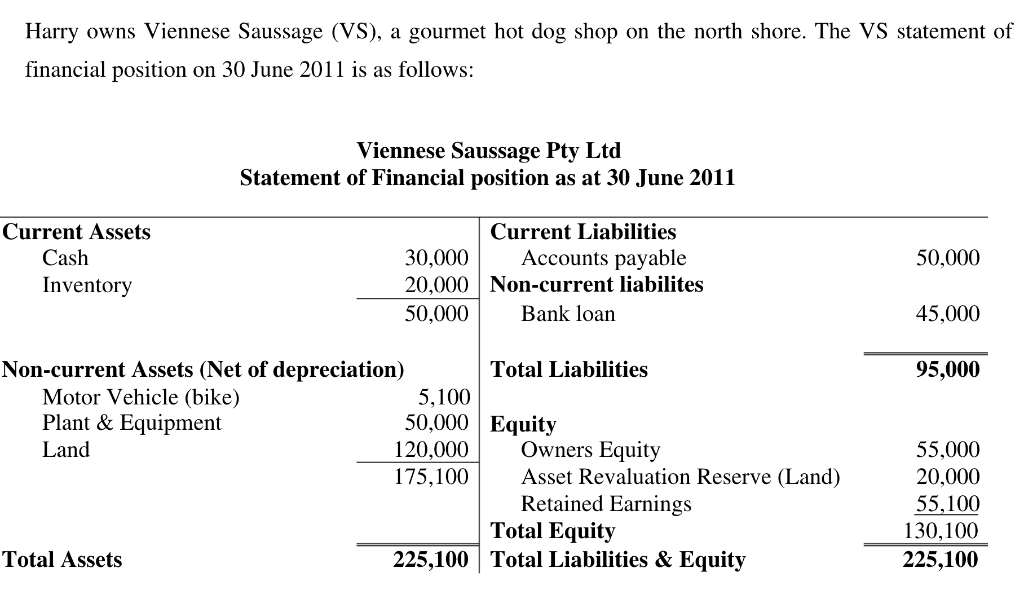

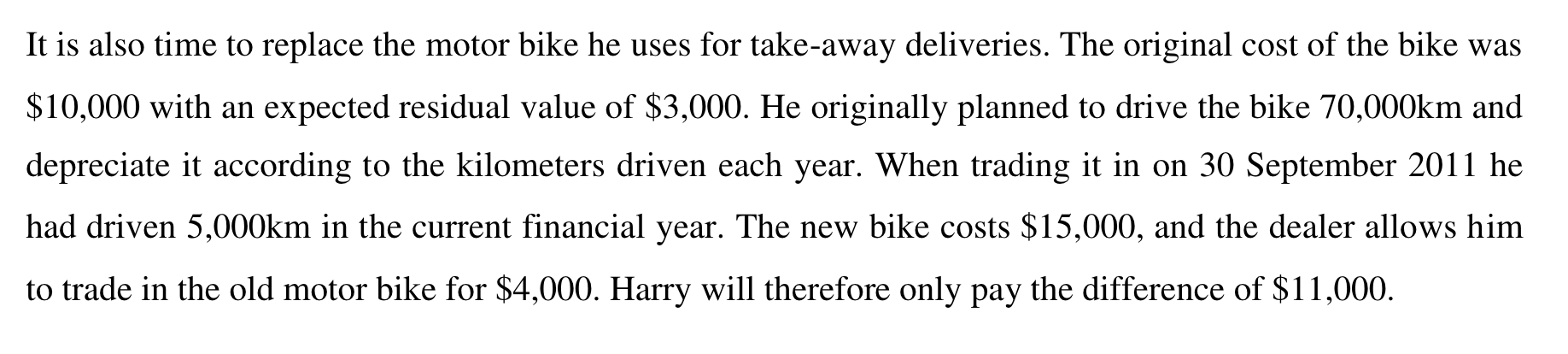

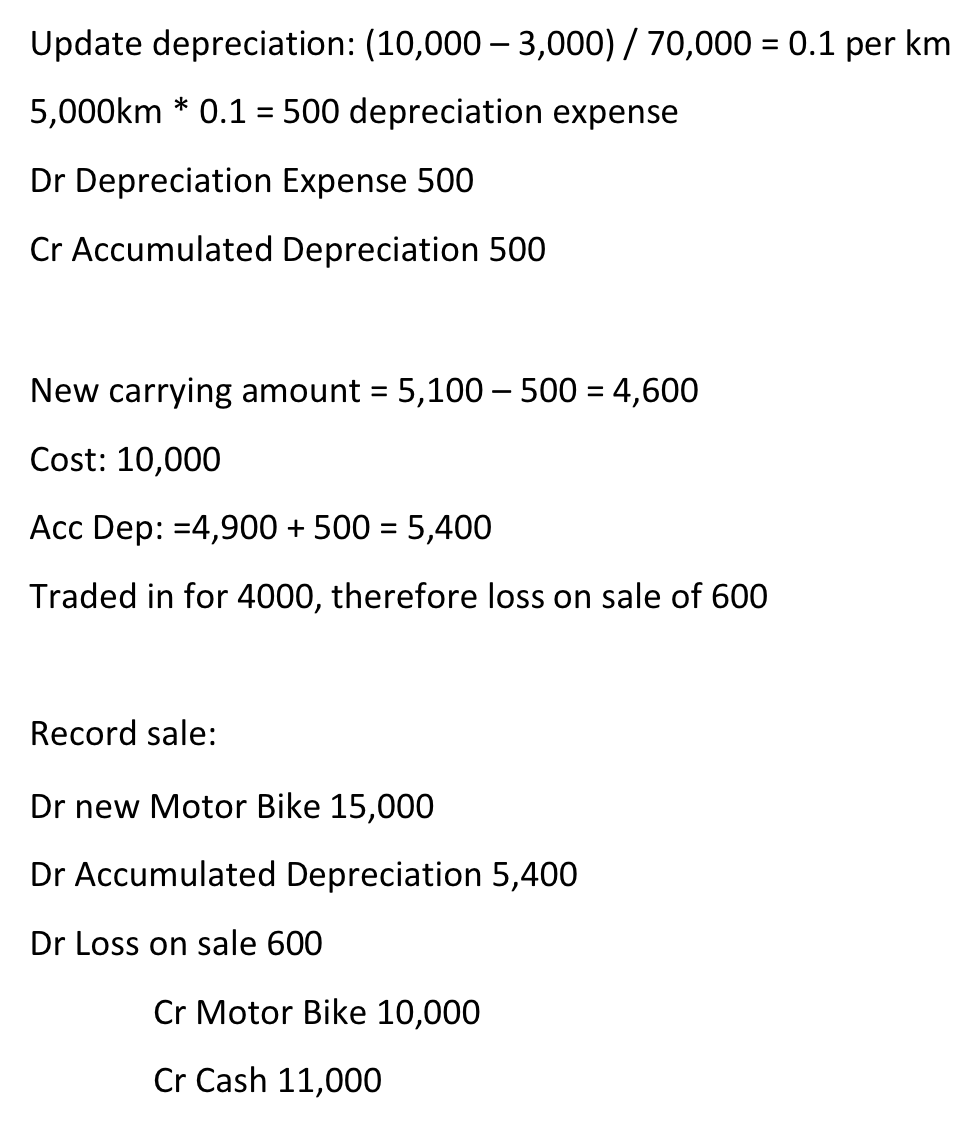

Harry owns Viennese Saussage (VS), a gourmet hot dog shop on the north shore. The VS statement of financial position on 30 June 2011 is as follows: Viennese Saussage Pty Ltd Statement of Financial position as at 30 June 2011 Current Assets Cash Inventory 50,000 Current Liabilities 30,000 Accounts payable 20,000 Non-current liabilites 50,000 Bank loan 45,000 95,000 Non-current Assets (Net of depreciation) Total Liabilities Motor Vehicle (bike) 5,100 Plant & Equipment 50,000 Equity Land 120,000 Owners Equity 175,100 Asset Revaluation Reserve (Land) Retained Earnings Total Equity Total Assets 225,100 Total Liabilities & Equity 55,000 20,000 55,100 130,100 225,100 It is also time to replace the motor bike he uses for take-away deliveries. The original cost of the bike was $10,000 with an expected residual value of $3,000. He originally planned to drive the bike 70,000km and depreciate it according to the kilometers driven each year. When trading it in on 30 September 2011 he had driven 5,000km in the current financial year. The new bike costs $15,000, and the dealer allows him to trade in the old motor bike for $4,000. Harry will therefore only pay the difference of $11,000. c) Journalise the disposal of the old motor bike & purchase of the new one. Show all workings for all your calculations. Update depreciation: (10,000 - 3,000) / 70,000 = 0.1 per km 5,000km * 0.1 = 500 depreciation expense Dr Depreciation Expense 500 Cr Accumulated Depreciation 500 New carrying amount = 5,100 500 = 4,600 Cost: 10,000 Acc Dep: =4,900 + 500 = 5,400 Traded in for 4000, therefore loss on sale of 600 Record sale: Dr new Motor Bike 15,000 Accumulated Depreciation 5,400 Dr Loss on sale 600 Cr Motor Bike 10,000 Cr Cash 11,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts