Question: Solve 1 d , 2 d , 3 d , 4 d . 1 a . Annuity EQ: Payback period = Cost / Annual cash

Solve dddd

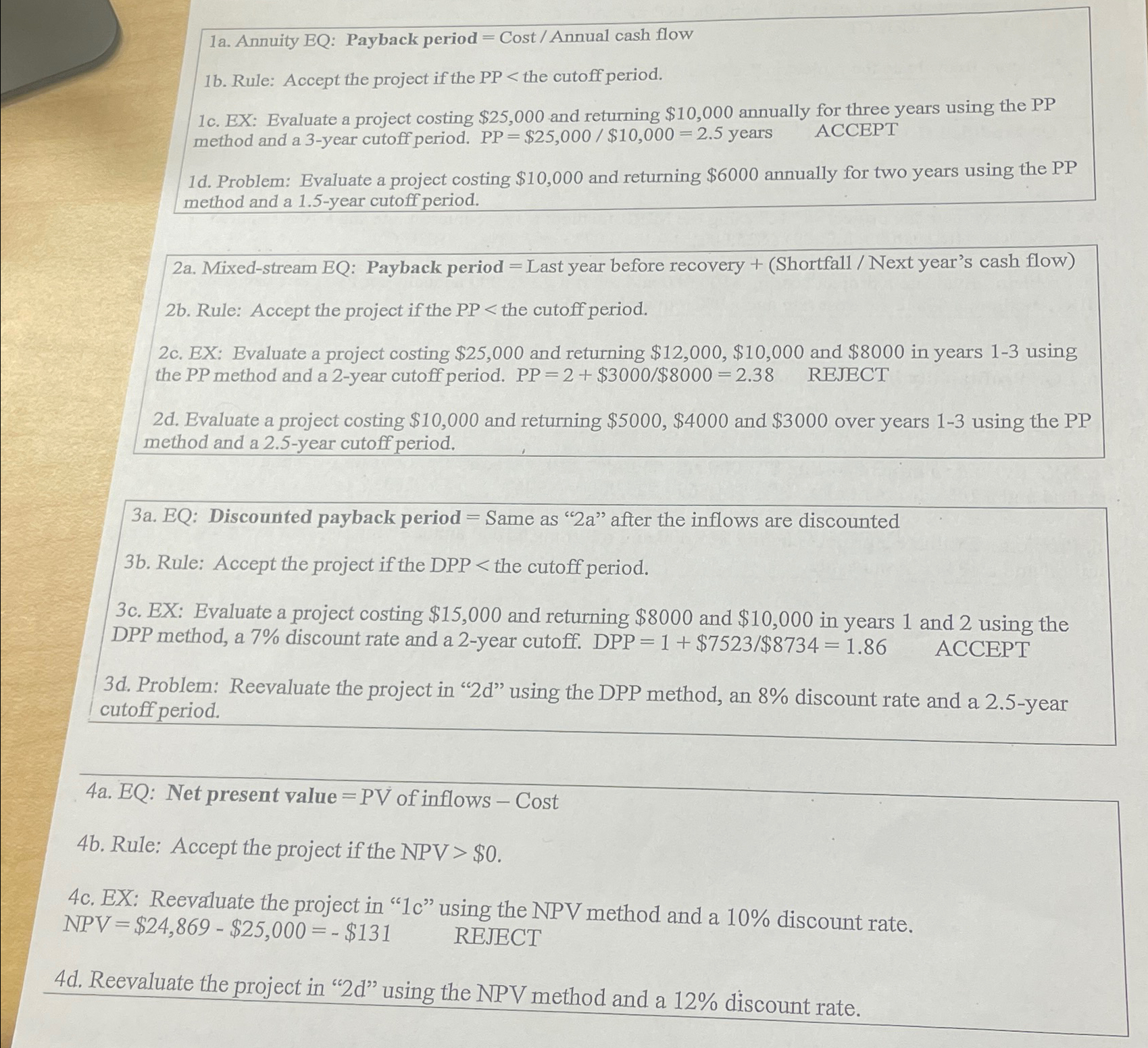

a Annuity EQ: Payback period Cost Annual cash flow

b Rule: Accept the project if the the cutoff period.

c EX: Evaluate a project costing $ and returning $ annually for three years using the PP method and a year cutoff period. $ years ACCEPT

d Problem: Evaluate a project costing $ and returning $ annually for two years using the PP method and a year cutoff period.

a Mixedstream EQ: Payback period Last year before recovery Shortfall Next year's cash flow

b Rule: Accept the project if the the cutoff period.

c EX: Evaluate a project costing $ and returning $$ and $ in years using the PP method and a year cutoff period. $ REJECT

d Evaluate a project costing $ and returning $$ and $ over years using the PP method and a year cutoff period.

a EQ: Discounted payback period Same as a after the inflows are discounted

b Rule: Accept the project if the DPP the cutoff period.

c EX: Evaluate a project costing $ and returning $ and $ in years and using the DPP method, a discount rate and a year cutoff. DPP $ ACCEPT

d Problem: Reevaluate the project in d using the DPP method, an discount rate and a year cutoff period.

a : Net present value of inflows Cost

b Rule: Accept the project if the NPV $

c EX: Reevaluate the project in using the NPV method and a discount rate.

$$$ REJECT

d Reevaluate the project in using the NPV method and a discount rate.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock