Question: Solve 14 and 15, given the answer to question 13. An FI has assets of $800 and equity of $50. If the duration of assets

Solve 14 and 15, given the answer to question 13.

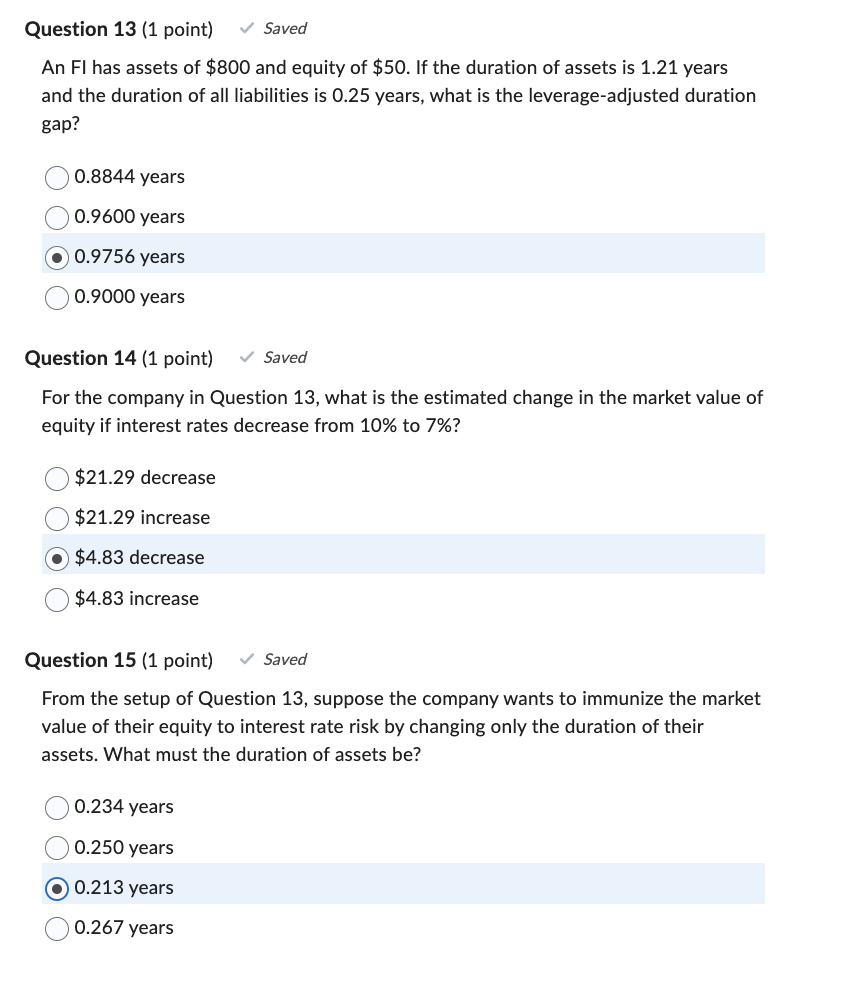

An FI has assets of $800 and equity of $50. If the duration of assets is 1.21 years and the duration of all liabilities is 0.25 years, what is the leverage-adjusted duration gap? 0.8844 years 0.9600 years 0.9756 years 0.9000 years Question 14 (1 point) Saved For the company in Question 13, what is the estimated change in the market value of equity if interest rates decrease from 10% to 7% ? $21.29 decrease $21.29 increase $4.83 decrease $4.83 increase Question 15 (1 point) Saved From the setup of Question 13, suppose the company wants to immunize the market value of their equity to interest rate risk by changing only the duration of their assets. What must the duration of assets be? 0.234 years 0.250 years 0.213 years 0.267 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts