Question: Solve 2, show your work For problems 2-3, the nodes of a two-period lattice are labeled as follows. A 6-month American put option on a

Solve 2, show your work

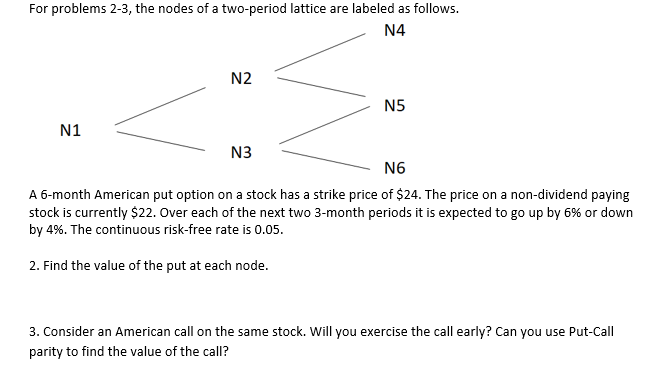

For problems 2-3, the nodes of a two-period lattice are labeled as follows. A 6-month American put option on a stock has a strike price of \$24. The price on a non-dividend paying stock is currently $22. Over each of the next two 3-month periods it is expected to go up by 6% or down by 4%. The continuous risk-free rate is 0.05. 2. Find the value of the put at each node. 3. Consider an American call on the same stock. Will you exercise the call early? Can you use Put-Call parity to find the value of the call? For problems 2-3, the nodes of a two-period lattice are labeled as follows. A 6-month American put option on a stock has a strike price of \$24. The price on a non-dividend paying stock is currently $22. Over each of the next two 3-month periods it is expected to go up by 6% or down by 4%. The continuous risk-free rate is 0.05. 2. Find the value of the put at each node. 3. Consider an American call on the same stock. Will you exercise the call early? Can you use Put-Call parity to find the value of the call

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts