Question: solve according to straight line method NOTE: this is the sixth time posting this question and all am getting is wrongs answers, please provide correct

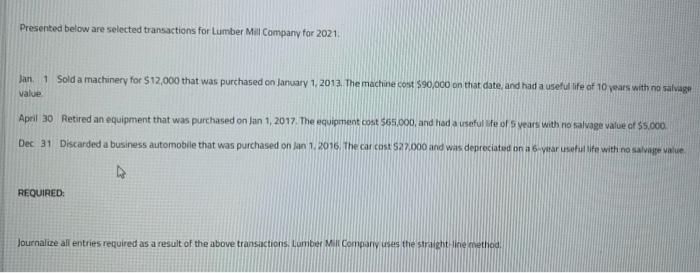

Presented below are selected transactions for Lumber Mill Company for 2021. Jan. 1 Sold a machinery for $12,000 that was purchased on January 1, 2013. The machine cost $90,000 on that date, and had a useful life of 10 years with no salvage value April 30 Retired an equipment that was purchased on Jan 1, 2017. The equipment cost 565.000, and had a useful life of years with no salvage value of 55.000 Dec 31 Discarded a business automobile that was purchased on an 1, 2016. The car cost $27.000 and was depreciated on a 6-year sotulife with no savage value REQUIRED: Journalize all entries required as a result of the above transactions. Lumber Mill Company uses the straight line method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts