Question: solve A-D please Larkin Hydraulics. On May 1, Larkin Hydraulics, a wholly owned subsidiary of Caterpillar (U.S), sold a 12 -meganatt compression turbine to Rebecte-Fenwlieger

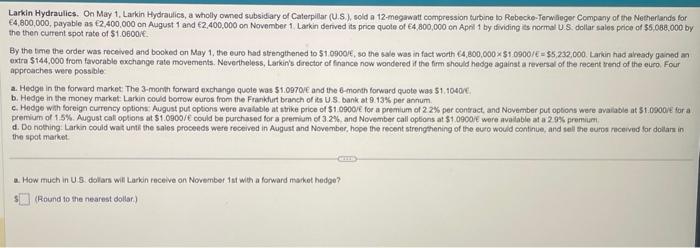

Larkin Hydraulics. On May 1, Larkin Hydraulics, a wholly owned subsidiary of Caterpillar (U.S), sold a 12 -meganatt compression turbine to Rebecte-Fenwlieger Company of the Netherlands for the then current spot rate of $1.0600re. extra $144,000 from favorable exchange rate movements. Nevertheless, Larkin's director of finance now wondered if the firm should hedge against a reversal of the recent thend of the euro. Four approaches were possible: a. Hedgu in the forward market: The 3-month forward exchange quote was 51.09701 and the emonth forward quote was 51,10400 . b. Hedge in the money market: Larkin could borrow euros from the Frankfurt beanch of iss U.S. bank at 9.13% per anhum. premium of 1.5%. August call oplions at $1.0900/ c could be purchased for a premism of 3.2%. and November call options at $1.0900/ wore avalable at a 2.9% premium d. Do nothing: Larkin could wat unts the sales proceeds were recerved in August and November, hope the recont strengthening of the euro would continue, and sell the euros racerved for dollan in the spot market. a. How much in U 8 . dollan wit Larkin receive on November 1 st with a forward muket hedge? (Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts