Question: Solve all parts else do not attempt Solve all parts with proper steps 1. A possible project will cost $75,000 but will result in cash

Solve all parts else do not attempt

Solve all parts with proper steps

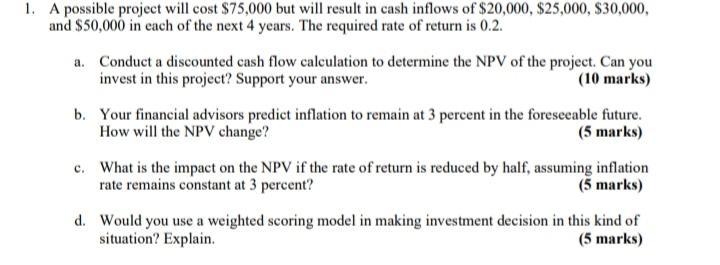

1. A possible project will cost $75,000 but will result in cash inflows of $20,000, $25,000, $30,000, and $50,000 in each of the next 4 years. The required rate of return is 0.2. a. Conduct a discounted cash flow calculation to determine the NPV of the project. Can you invest in this project? Support your answer. (10 marks) b. Your financial advisors predict inflation to remain at 3 percent in the foreseeable future. How will the NPV change? (5 marks) c. What is the impact on the NPV if the rate of return is reduced by half, assuming inflation rate remains constant at 3 percent? (5 marks) d. Would you use a weighted scoring model in making investment decision in this kind of situation? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts