Question: solve all please Reference Reference Reference Reference begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} hline begin{tabular}{l} renod 17 end{tabular} & 0.0440 & 0.174 & 0.000 & [0.513 & 0.430 &

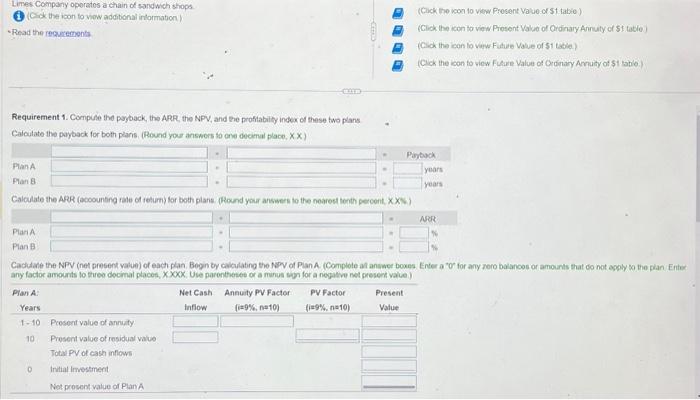

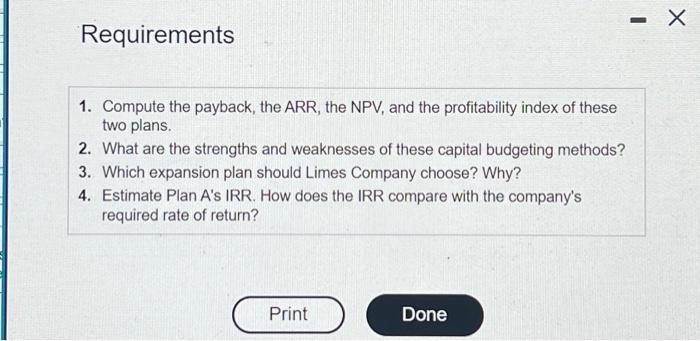

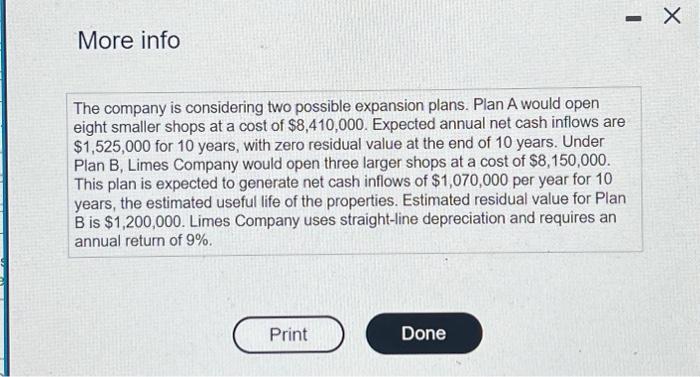

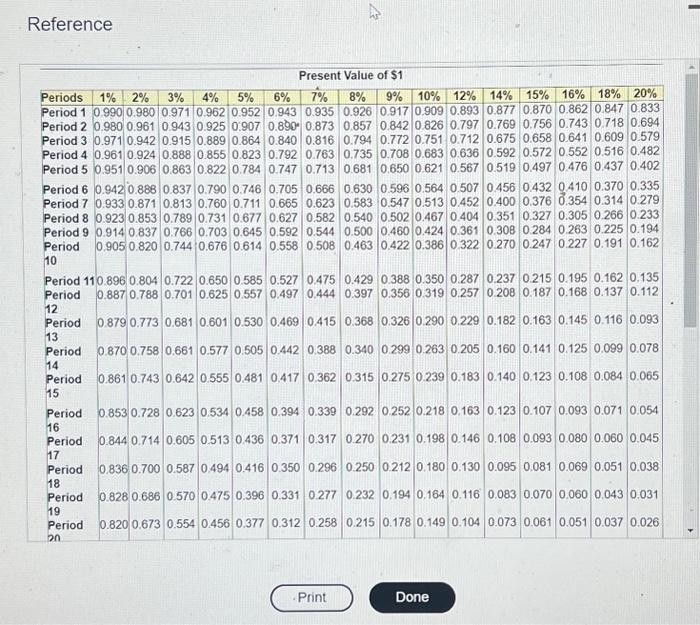

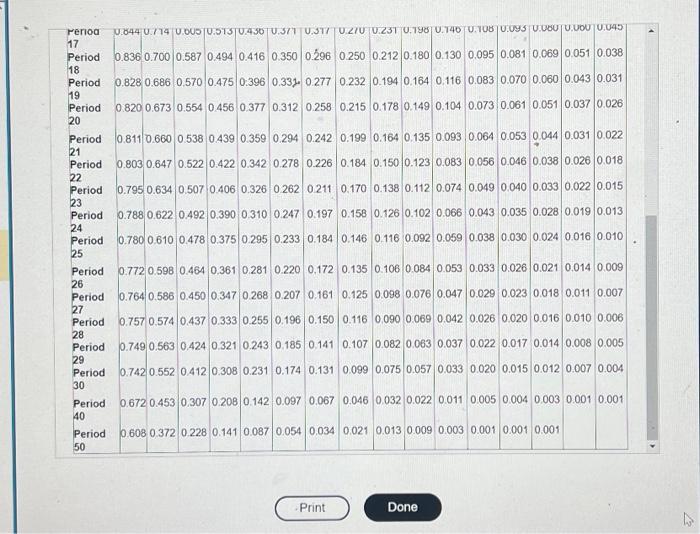

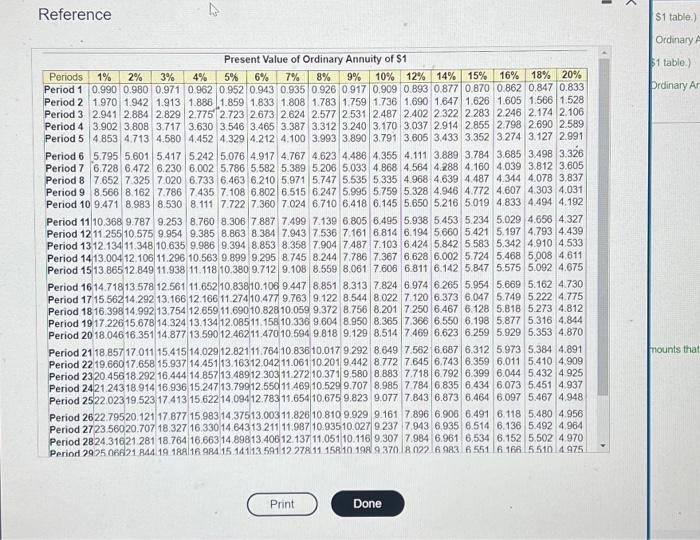

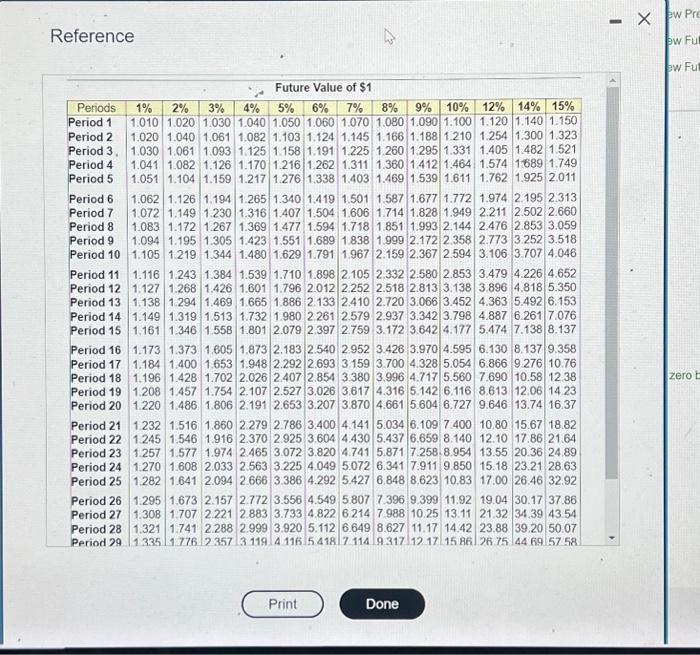

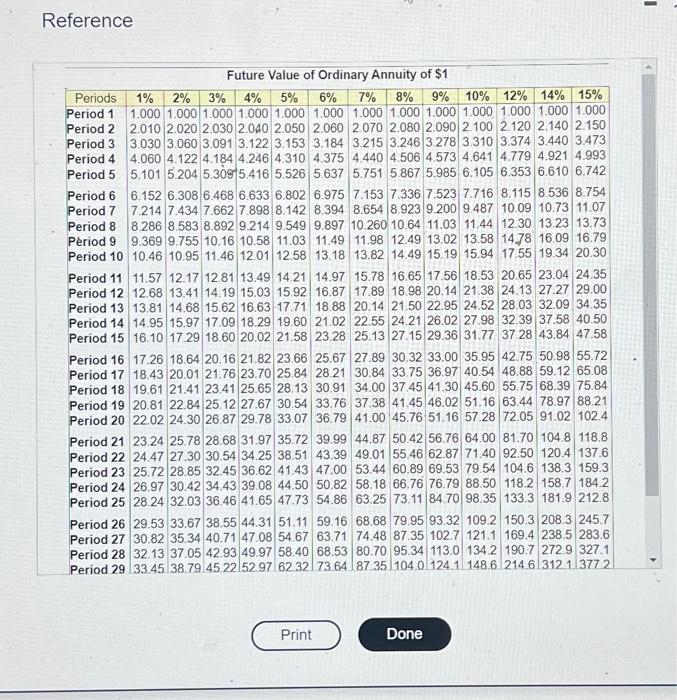

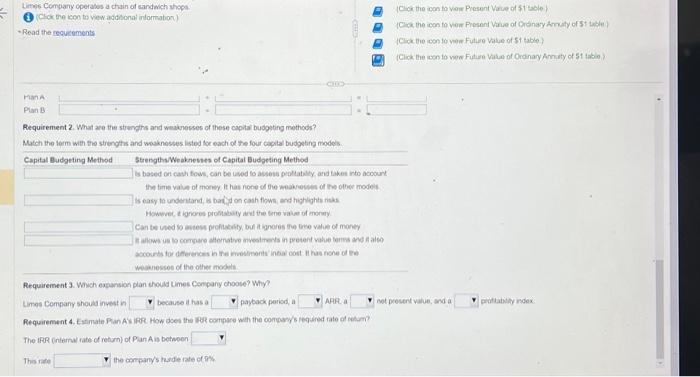

Reference Reference Reference Reference \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \begin{tabular}{l} renod \\ 17 \end{tabular} & 0.0440 & 0.174 & 0.000 & [0.513 & 0.430 & 0.371 & U.STI & 0.10 & 0.231 & 0.798 & 0.740 & 0.108 & 0.09s & U.000 & [u.vou & 0.045 & \\ \hline \begin{tabular}{l} Period \\ 18 \end{tabular} & 0.8360 & 0.700 & 0.587 & 0.494 & 0.416 & 0.350 & 0.296 & 0.250 & 0.212 & 0.180 & 0.130 & 0.095 & 0.081 & 0.069 & 0.051 & 0.038 & \\ \hline \begin{tabular}{l} Period \\ 19 \end{tabular} & 0.828 & 0.686 & 0.570 & 0.475 & 0:396 & 0.332 & 0.277 & 0.232 & 0.194 & 0.164 & 0.116 & 0.083 & 0.070 & 0.060 & 0.043 & 0.031 & \\ \hline \begin{tabular}{l} Period \\ 20 \end{tabular} & 0.8200 & 0.673 & 0.554 & 0.456 & 0.377 & 0.312 & 0.258 & 0.215 & 0.178 & 0.149 & 0.104 & 0.073 & 0.061 & 0.051 & 0.037 & 0.026 & \\ \hline \begin{tabular}{l} Period \\ 21 \end{tabular} & 0.811 & 0.660 & 0.538 & 0.439 & 0.359 & 0.294 & 0.242 & 0.199 & 0.164 & 0.135 & 0.093 & 0.064 & 0.053 & 0.044 & 0.031 & 0.022 & \\ \hline \begin{tabular}{l} Period \\ 22 \end{tabular} & 0.803 & 0.647 & 0.522 & 0.422 & 0.342 & 0.278 & 0.226 & 0.184 & 0.150 & 0.123 & 0.083 & 0.056 & 0.046 & 0.038 & 0.026 & 0.018 & \\ \hline \begin{tabular}{l} Period \\ 23 \end{tabular} & 0.795 & 0.634 & 0.507 & 0.406 & 0.326 & 0262 & 0.211 & 0.170 & 0.138 & 0.112 & 0.074 & 0.049 & 0.040 & 0.033 & 0.022 & 0.015 & \\ \hline \begin{tabular}{l} Period \\ 24 \end{tabular} & 0.788 & 0.622 & 0.492 & 0.390 & 0.310 & 0.247 & 0.197 & 0.158 & 0.126 & 0.102 & 0.066 & 0.043 & 0.035 & 0.028 & 0.019 & 0.013 & \\ \hline \begin{tabular}{l} Period \\ 25 \end{tabular} & 0.780 & 0.610 & 0.478 & 0.375 & 0.295 & 0.233 & 0.184 & 0.146 & 0.116 & 0.092 & 0.059 & 0.038 & 0.030 & 0.024 & 0.016 & 0.010 & \\ \hline \begin{tabular}{l} Period \\ 26 \end{tabular} & 0.772 & 0.598 & 0.464 & 0.361 & 0.281 & 0.220 & 0.172 & 0.135 & 0.106 & 0.084 & 0.053 & 0.033 & 0.026 & 0.021 & 0.014 & 0.009 & \\ \hline \begin{tabular}{l} Period \\ 27 \end{tabular} & 0.764 & 0.586 & 0.450 & 0.347 & 0.268 & 0.207 & 0.161 & 0.125 & 0.098 & 0.076 & 0.047 & 0.029 & 0.023 & 0.018 & 0.011 & 0.007 & \\ \hline \begin{tabular}{l} Period \\ 28 \end{tabular} & 0.757 & 0.574 & 0.437 & 0.333 & 0.255 & 0.196 & 0.150 & 0.116 & 0.090 & 0.069 & 0.042 & 0.026 & 0.020 & 0.016 & 0.010 & 0.006 & \\ \hline \begin{tabular}{l} Period \\ 29 \end{tabular} & 0.749 & 0.563 & 0.424 & 0.321 & 0.243 & 0.185 & 0.141 & 0.107 & 0.082 & 0.063 & 0.037 & 0.022 & 0.017 & 0.014 & 0.008 & 0.005 & \\ \hline \begin{tabular}{l} Period \\ 30 \end{tabular} & 0.742 & 0.552 & 0.412 & 0.308 & 0.231 & 0.174 & 0.131 & 0.099 & 0.075 & 0.057 & 0.033 & 0.020 & 0.015 & 0.012 & 0.007 & 0.004 & \\ \hline \begin{tabular}{l} Period \\ 40 \end{tabular} & 0.672 & 0.453 & 0,307 & 0.208 & 0.142 & 0.097 & 0.067 & 0.046 & 0.032 & 0.022 & 0.011 & 0.005 & 0.004 & 0.003 & 0.001 & 0.001 & \\ \hline \begin{tabular}{l} Period \\ 50 \end{tabular} & 0.608 & 30.372 & 0.228 & 0.141 & 0.087 & 0.054 & 0.034 & 0.021 & 0.013 & 0.009 & 0.003 & 0.001 & 0.001 & 0.001 & & & 7 \\ \hline \end{tabular} Requirements 1. Compute the payback, the ARR, the NPV, and the profitability index of these two plans. 2. What are the strengths and weaknesses of these capital budgeting methods? 3. Which expansion plan should Limes Company choose? Why? 4. Estimate Plan A's IRR. How does the IRR compare with the company's required rate of return? More info The company is considering two possible expansion plans. Plan A would open eight smaller shops at a cost of $8,410,000. Expected annual net cash inflows are $1,525,000 for 10 years, with zero residual value at the end of 10 years. Under Plan B, Limes Company would open three larger shops at a cost of $8,150,000. This plan is expected to generate net cash inflows of $1,070,000 per year for 10 years, the estimated useful life of the properties. Estimated residual value for Plan B is $1,200,000. Limes Company uses straight-line depreciation and requires an annual return of 9%. Litwes Company cperabos a chain of sandwich shopa. (3) (ctid tro icon to vew addionat intormation) - Read the requicuments (Clia the con to vere Future Valie of 51 table) ManA: 1 Pan B Requirement 2. What are the strengths and weaknesses of these capitar budgeting mothods? Match the lerm with the stronatis and wosknestes listed for each of the four cacital budoetira modes. Requirement 3 Which exparsion plan should Umes Conpariy choose? Why? Unes Company shouls incest in because it has a payback pariod, a APR a set present value, and a prothatidify index: The IRR (niterna rate of return) of Pan A is between This inhe the companys herde rate of 10 \% Limes Company operatos a chain of sandwich shops (B) (coct the ionn to vow additional intormation) (Clack the icon to view Prosent Vatie-clst tatie) - Read the cequrementh (Click ihe icon to view Prosent Value of Ordinary Arinuly of 5 t table) (Cick the icon lo vew Fidue Value of $1 t Bale) (Click the icon fo view Fuare Value of Ordiary Amuity of $1 t tatio) Requirement 1. Complie the payback, the ARR, the NPV, and Rhe profitability inder of these two plans Calculate the payback for both plans. (Round your answers fo one decinal place, X ) Calculate the ARR (acoounting rate of ietum) for both plars (Pound your answers to the nearest lenth peccont, XXX)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts