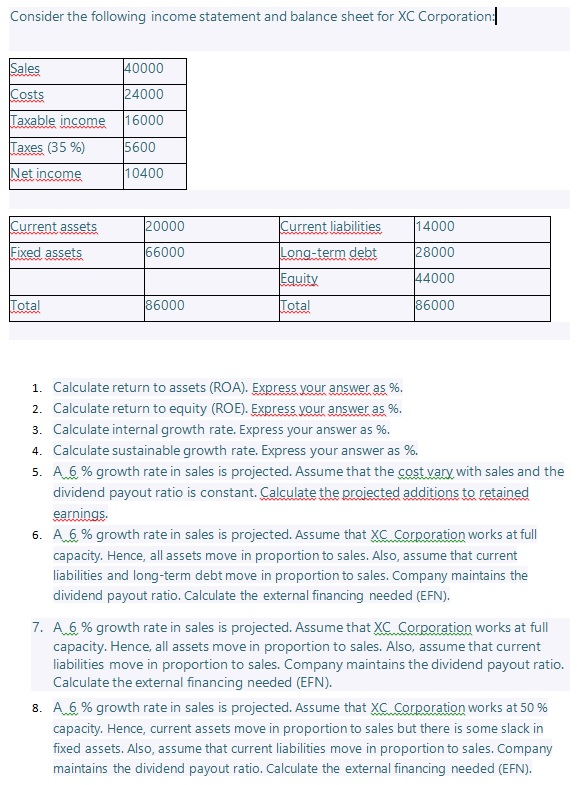

Question: Solve all the tasks and consider dividend payout ratio is 49% where it is required. Consider the following income statement and balance sheet for XC

Solve all the tasks and consider dividend payout ratio is 49% where it is required.

Consider the following income statement and balance sheet for XC Corporation:|| Sales 40000 Costs 24000 Taxable income 16000 Taxes (35%) 15600 Net income 10400 Current assets 120000 14000 Fixed assets 66000 |28000 Current liabilities Long-term debt Equity Total 44000 Total 86000 |86000 1. Calculate return to assets (ROA). Express your answer as %. 2. Calculate return to equity (ROE). Express your answer as %. 3. Calculate internal growth rate. Express your answer as %. 4. Calculate sustainable growth rate. Express your answer as %. 5. A 6% growth rate in sales is projected. Assume that the cost vary with sales and the dividend payout ratio is constant. Calculate the projected additions to retained earnings. 6. A 6% growth rate in sales is projected. Assume that XC Corporation works at full capacity. Hence, all assets move in proportion to sales. Also, assume that current liabilities and long-term debt move in proportion to sales. Company maintains the dividend payout ratio. Calculate the external financing needed (EFN). 7. A 6% growth rate in sales is projected. Assume that XC Corporation works at full capacity. Hence, all assets move in proportion to sales. Also, assume that current liabilities move in proportion to sales. Company maintains the dividend payout ratio. Calculate the external financing needed (EFN). 8. A 6 % growth rate in sales is projected. Assume that XC Corporation works at 50 % capacity. Hence, current assets move in proportion to sales but there is some slack in fixed assets. Also, assume that current liabilities move in proportion to sales. Company maintains the dividend payout ratio. Calculate the external financing needed (EFN)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts