Question: solve any 2 questions urgently please thumbs up will be given 9. Shares in Liwa Chem (L) and Sur Plastic (S) lie on the security

solve any 2 questions urgently please thumbs up will be given

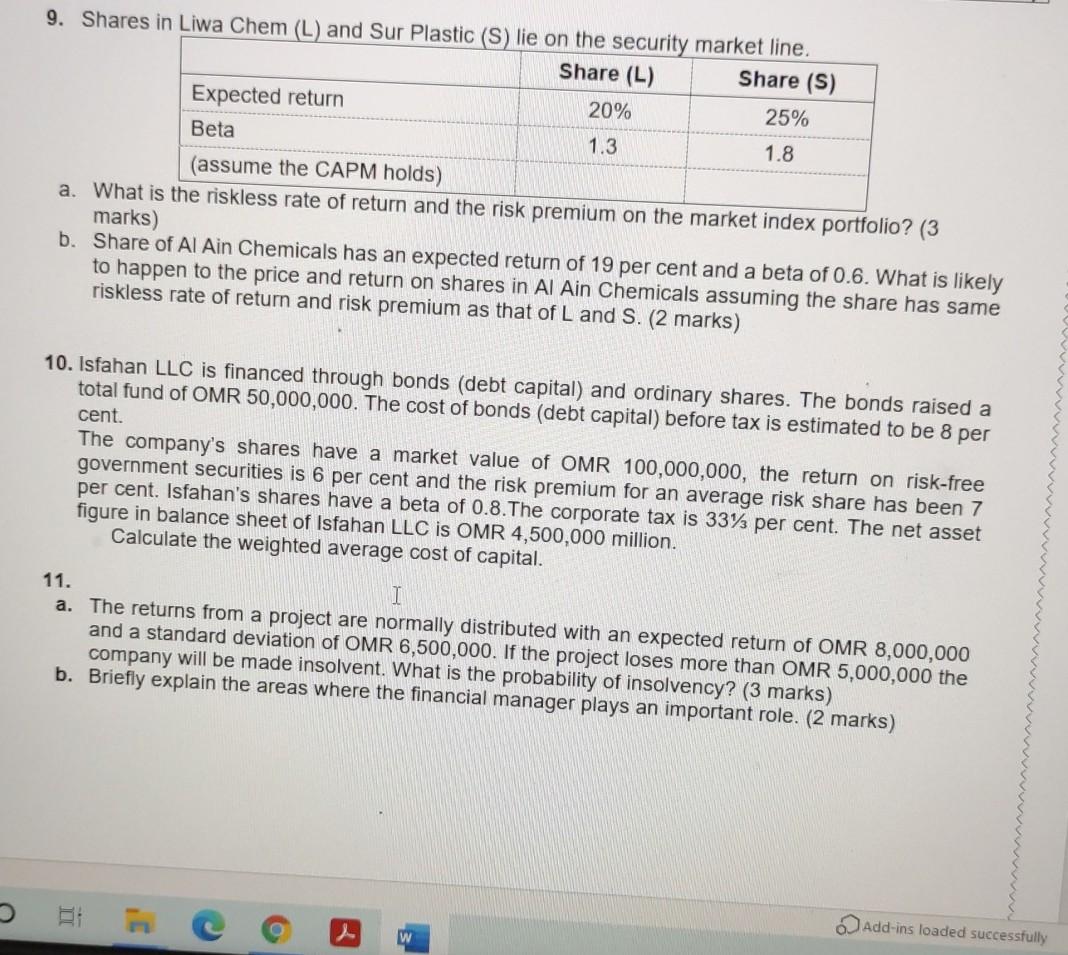

9. Shares in Liwa Chem (L) and Sur Plastic (S) lie on the security market line. Share (L) Share (S) Expected return 20% 25% Beta 1.3 1.8 (assume the CAPM holds) a. What is the riskless rate of return and the risk premium on the market index portfolio? (3 marks) b. Share of Al Ain Chemicals has an expected return of 19 per cent and a beta of 0.6. What is likely to happen to the price and return on shares in Al Ain Chemicals assuming the share has same riskless rate of return and risk premium as that of L and S. (2 marks) 10. Isfahan LLC is financed through bonds (debt capital) and ordinary shares. The bonds raised a total fund of OMR 50,000,000. The cost of bonds (debt capital) before tax is estimated to be 8 per cent. The company's shares have a market value of OMR 100,000,000, the return on risk-free government securities is 6 per cent and the risk premium for an average risk share has been 7 per cent. Isfahan's shares have a beta of 0.8. The corporate tax is 33% per cent. The net asset figure in balance sheet of Isfahan LLC is OMR 4,500,000 million. Calculate the weighted average cost of capital. 11. I a. The returns from a project are normally distributed with an expected return of OMR 8,000,000 and a standard deviation of OMR 6,500,000. If the project loses more than OMR 5,000,000 the company will be made insolvent. What is the probability of insolvency? (3 marks) b. Briefly explain the areas where the financial manager plays an important role. (2 marks) Add-ins loaded successfully 2 W

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts