Question: Solve any questions here: Problem 1. [25 points] The current spot interest rates with continuous compounding are as follows: Quarter Maturity (months) Rate (% per

Solve any questions here:

![Solve any questions here: Problem 1. [25 points] The current spot interest](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67063875ca6c6_91767063875b121c.jpg)

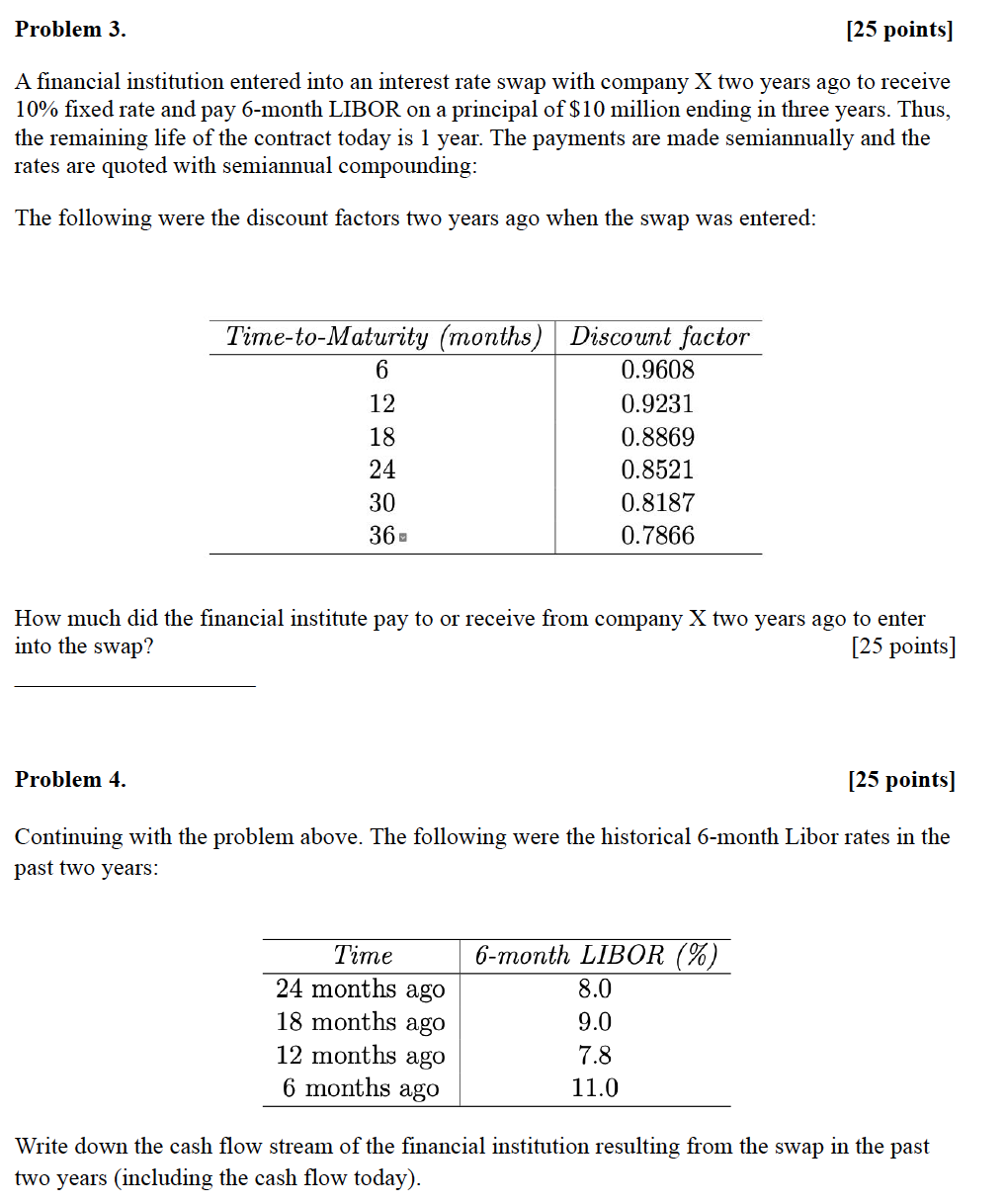

Problem 1. [25 points] The current spot interest rates with continuous compounding are as follows: Quarter Maturity (months) Rate (% per annum) 1 3 8.0 2 6 8.2 3 9 8.4 4 12 8.5 5 15 8.6 6 18 8.7 Find the corresponding continuously compounded annual forward rates for the quarters 2 6. Problem 2. [25 points] Assume the continuously compounded spot rates of Problem 1. Find the value of an FRA that enables the holder to pay a xed rate of 9.5%, compounded quarterly, for one quarter starting in 1 year and ending in 15 months, and receive oating rates, on a principal of $2,000,000. Problem 3. [25 points] A financial institution entered into an interest rate swap with company X two years ago to receive 10% fixed rate and pay 6-month LIBOR on a principal of $10 million ending in three years. Thus, the remaining life of the contract today is 1 year. The payments are made semiannually and the rates are quoted with semiannual compounding: The following were the discount factors two years ago when the swap was entered: Time-to-Maturity (months) |Discount factor 6 0.9608 12 0.9231 18 0.8869 24 0.8521 30 0.8187 36= 0.7866 How much did the financial institute pay to or receive from company X two years ago to enter into the swap? [25 points] Problem 4. [25 points] Continuing with the problem above. The following were the historical 6-month Libor rates in the past two years: Time 6-month LIBOR (%) 24 months ago 8.0 18 months ago 9.0 12 months ago 7.8 6 months ago 11.0 Write down the cash flow stream of the financial institution resulting from the swap in the past two years (including the cash flow today)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts