Question: Solve as much as you can from these questions, please. (a) Suppose a stock price is $50, the volatility of the stock is o =

Solve as much as you can from these questions, please.

Solve as much as you can from these questions, please.

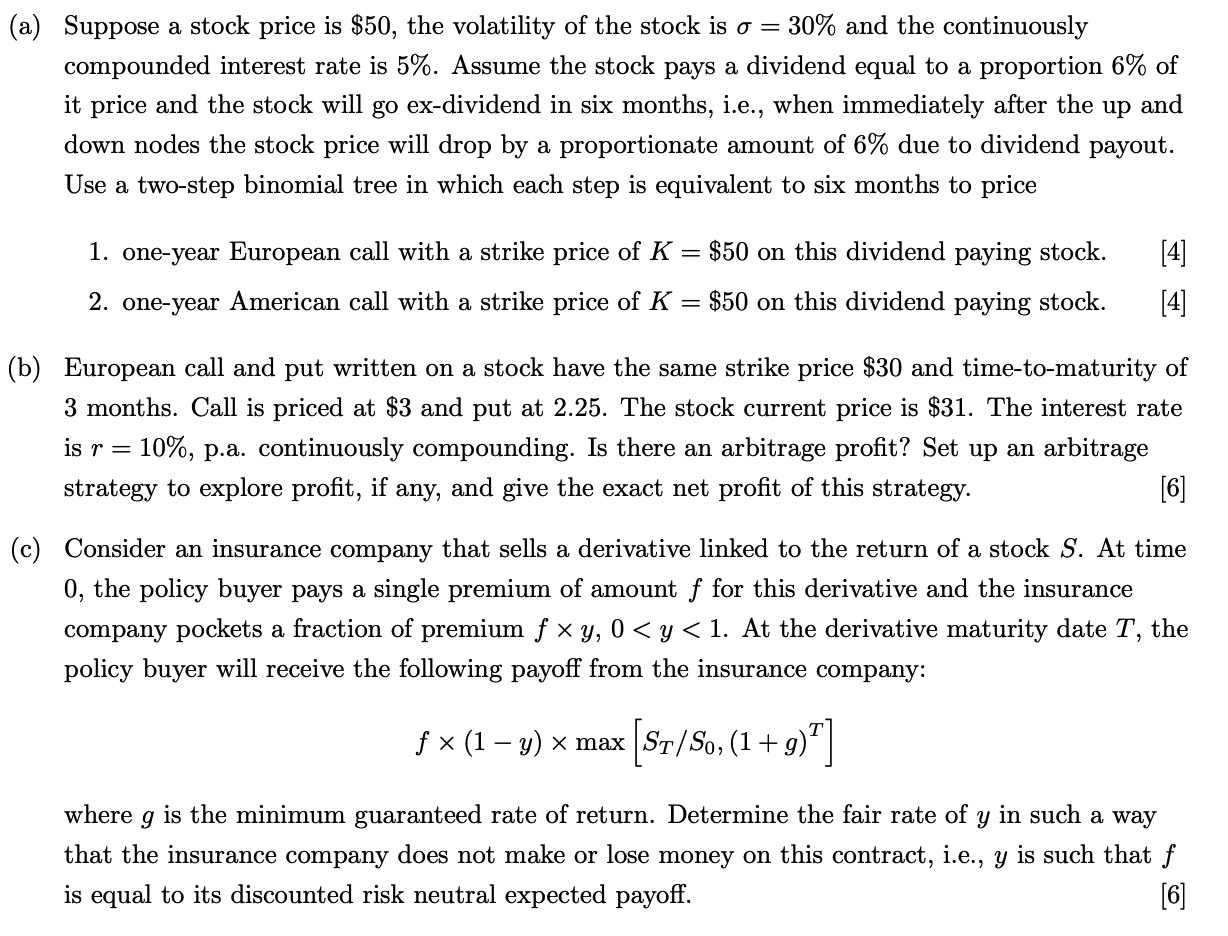

(a) Suppose a stock price is $50, the volatility of the stock is o = 30% and the continuously compounded interest rate is 5%. Assume the stock pays a dividend equal to a proportion 6% of it price and the stock will go ex-dividend in six months, i.e., when immediately after the up and down nodes the stock price will drop by a proportionate amount of 6% due to dividend payout. Use a two-step binomial tree in which each step is equivalent to six months to price 1. one-year European call with a strike price of K = $50 on this dividend paying stock. 2. one-year American call with a strike price of K $50 on this dividend paying stock. [4] [4] (b) European call and put written on a stock have the same strike price $30 and time-to-maturity of 3 months. Call is priced at $3 and put at 2.25. The stock current price is $31. The interest rate is r = 10%, p.a. continuously compounding. Is there an arbitrage profit? Set up an arbitrage strategy to explore profit, if any, and give the exact net profit of this strategy. [6] (c) Consider an insurance company that sells a derivative linked to the return of a stock S. At time 0, the policy buyer pays a single premium of amount f for this derivative and the insurance company pockets a fraction of premium f xy, 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts