Question: solve both Please use the following statistics to answer questions 26 and 27 regarding Psi inc. Risk-free return 3% Market portfolio's expected returns 12% Market

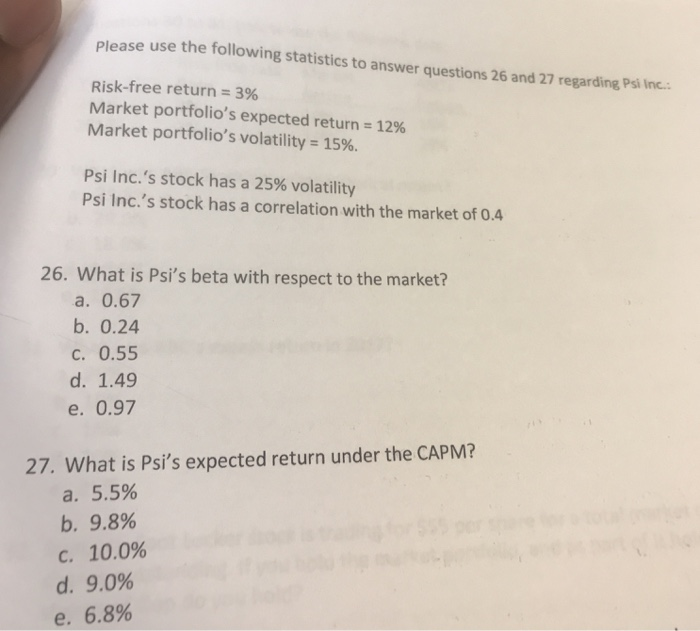

Please use the following statistics to answer questions 26 and 27 regarding Psi inc. Risk-free return 3% Market portfolio's expected returns 12% Market portfolio's volatilitys 15%. Psi Inc.'s stock has a 25% volatility Psi Inc.'s stock has a correlation with the market of 0.4 26. What is Psi's beta with respect to the market? a. 0.67 b. 0.24 c. 0.55 d. 1.49 e. 0.97 27. What is Psi's expected return under the CAPM? a. 5.5% b. 9.8% c. 10.0% d. 9.0% e. 6.8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts