Question: Using annual data from year 1980 to year 2016, we aim to study relationship between housing price and investment. We observe invpc=real housing investment per

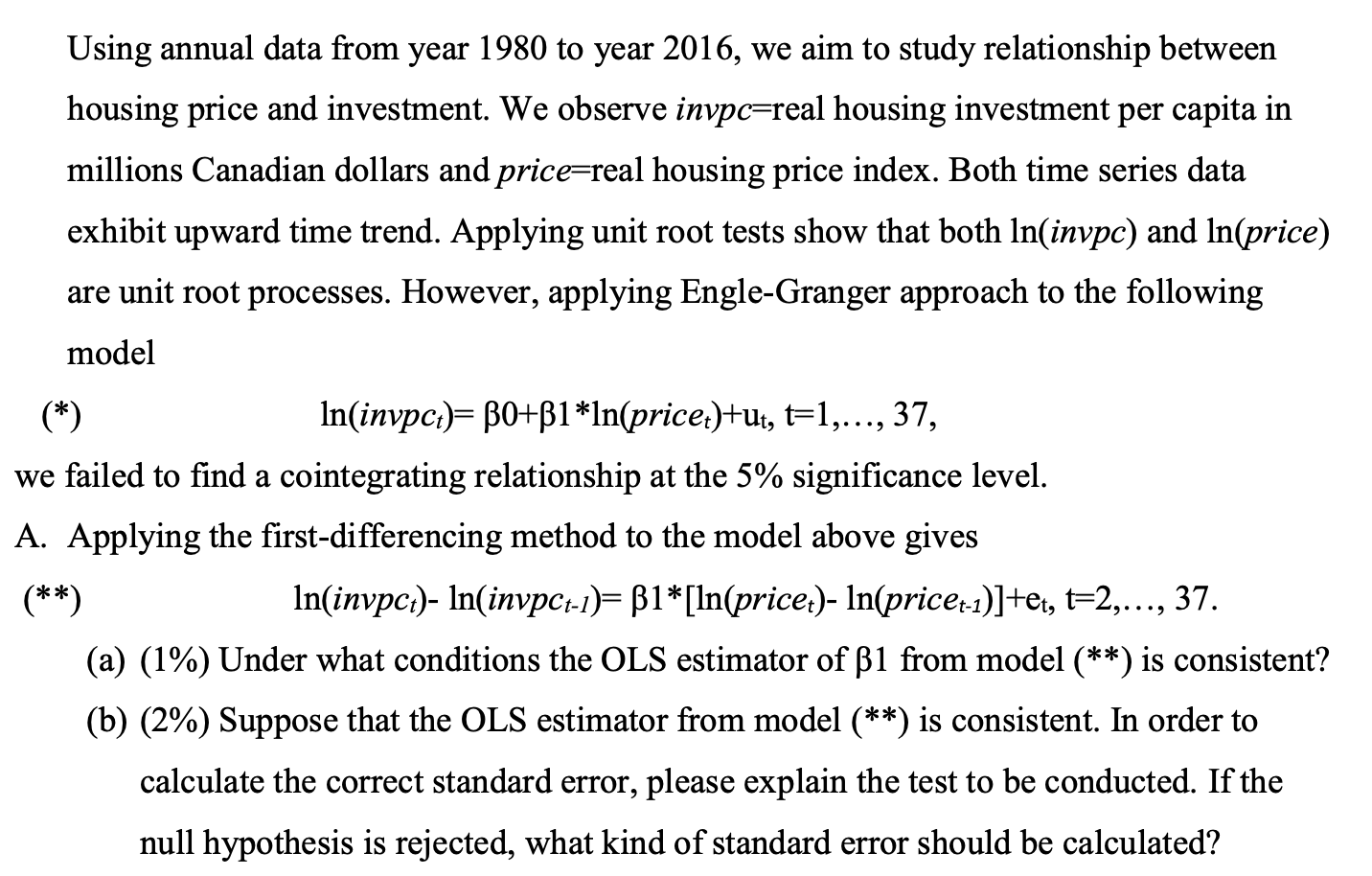

Using annual data from year 1980 to year 2016, we aim to study relationship between housing price and investment. We observe invpc=real housing investment per capita in millions Canadian dollars and price=real housing price index. Both time series data exhibit upward time trend. Applying unit root tests show that both ln(invpc) and In(price) are unit root processes. However, applying Engle-Granger approach to the following model In(invpct)= BO+B1*In(pricet)+ut, t=1,..., 37, we failed to find a cointegrating relationship at the 5% significance level. A. Applying the first-differencing method to the model above gives (**) In(invpct)- In(invpct-1)=31*[ln(price)- In(pricet-1)]+et, t=2,..., 37. (a) (1%) Under what conditions the OLS estimator of B1 from model (**) is consistent? (b) (2%) Suppose that the OLS estimator from model (**) is consistent. In order to calculate the correct standard error, please explain the test to be conducted. If the null hypothesis is rejected, what kind of standard error should be calculated? Using annual data from year 1980 to year 2016, we aim to study relationship between housing price and investment. We observe invpc=real housing investment per capita in millions Canadian dollars and price=real housing price index. Both time series data exhibit upward time trend. Applying unit root tests show that both ln(invpc) and In(price) are unit root processes. However, applying Engle-Granger approach to the following model In(invpct)= BO+B1*In(pricet)+ut, t=1,..., 37, we failed to find a cointegrating relationship at the 5% significance level. A. Applying the first-differencing method to the model above gives (**) In(invpct)- In(invpct-1)=31*[ln(price)- In(pricet-1)]+et, t=2,..., 37. (a) (1%) Under what conditions the OLS estimator of B1 from model (**) is consistent? (b) (2%) Suppose that the OLS estimator from model (**) is consistent. In order to calculate the correct standard error, please explain the test to be conducted. If the null hypothesis is rejected, what kind of standard error should be calculated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts