Question: solve by Excel. Please do the tree and put the formula you used. 2. (10 pt each) Consider a non-dividend-paying stock whose current price S(0)-S

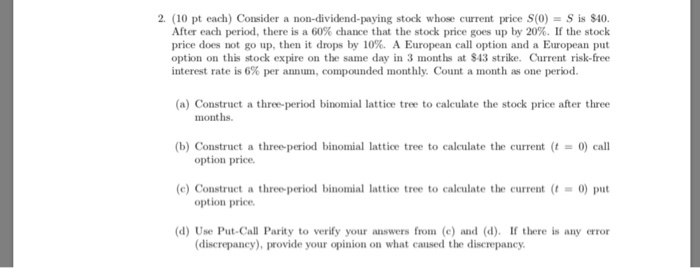

2. (10 pt each) Consider a non-dividend-paying stock whose current price S(0)-S is $40. After each period, there is a 60% chance that the stock price goes up by 20%. If the stock price does not go up, then it drops by 10%. A European call option and a European put option on this stock expire on the same day in 3 months at $43 strike. Current risk-free interest rate is 6% per annum, compounded monthly. Count a month as one period. (a) Construct a three-period binomial lattice tree to caleulate the stock price after three months. (b) Construct a three-period binomial lattice tree to calculate the current(t-0) call option price. (c) Construct a three-period binomial lattice tree to caleulate the current (t-0) pu option price (d) Use Put-Call Parity to verify your answers from (e) and (d). If there is any error discrepancy), provide your opinion on what caused the discrepancy. 2. (10 pt each) Consider a non-dividend-paying stock whose current price S(0)-S is $40. After each period, there is a 60% chance that the stock price goes up by 20%. If the stock price does not go up, then it drops by 10%. A European call option and a European put option on this stock expire on the same day in 3 months at $43 strike. Current risk-free interest rate is 6% per annum, compounded monthly. Count a month as one period. (a) Construct a three-period binomial lattice tree to caleulate the stock price after three months. (b) Construct a three-period binomial lattice tree to calculate the current(t-0) call option price. (c) Construct a three-period binomial lattice tree to caleulate the current (t-0) pu option price (d) Use Put-Call Parity to verify your answers from (e) and (d). If there is any error discrepancy), provide your opinion on what caused the discrepancy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts