Question: Consider a non-dividend-paying stock whose current price 5(0) = S is $40. After each period, there is a 60% chance that the stock price goes

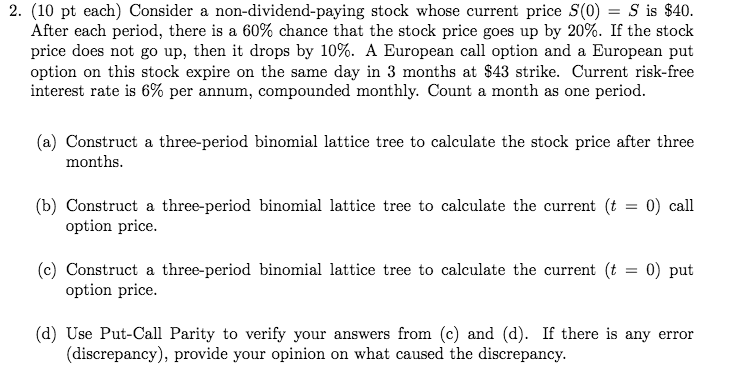

Consider a non-dividend-paying stock whose current price 5(0) = S is $40. After each period, there is a 60% chance that the stock price goes up by 20%. If the stock price does not go up, then it drops by 10%. A European call option and a European put option on this stock expire on the same day in 3 months at $43 strike. The current risk-free interest rate is 6% per annum, compounded monthly. Count a month as one period. Construct a three-period binomial lattice tree to calculate the stock price after three months. Construct a three-period binomial lattice tree to calculate the current (t = 0) call option price. Construct a three-period binomial lattice tree to calculate the current (t = 0) put option price. Use Put-Call Parity to verify your answers from (c) and (d). If there is any error (discrepancy), provide your opinion on what caused the discrepancy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts