Question: Solve by hand step by step with formula Suppose your firm earns $9 million in taxable income. 2.1. What is the firm's tax liability? (5

Solve by hand step by step with formula

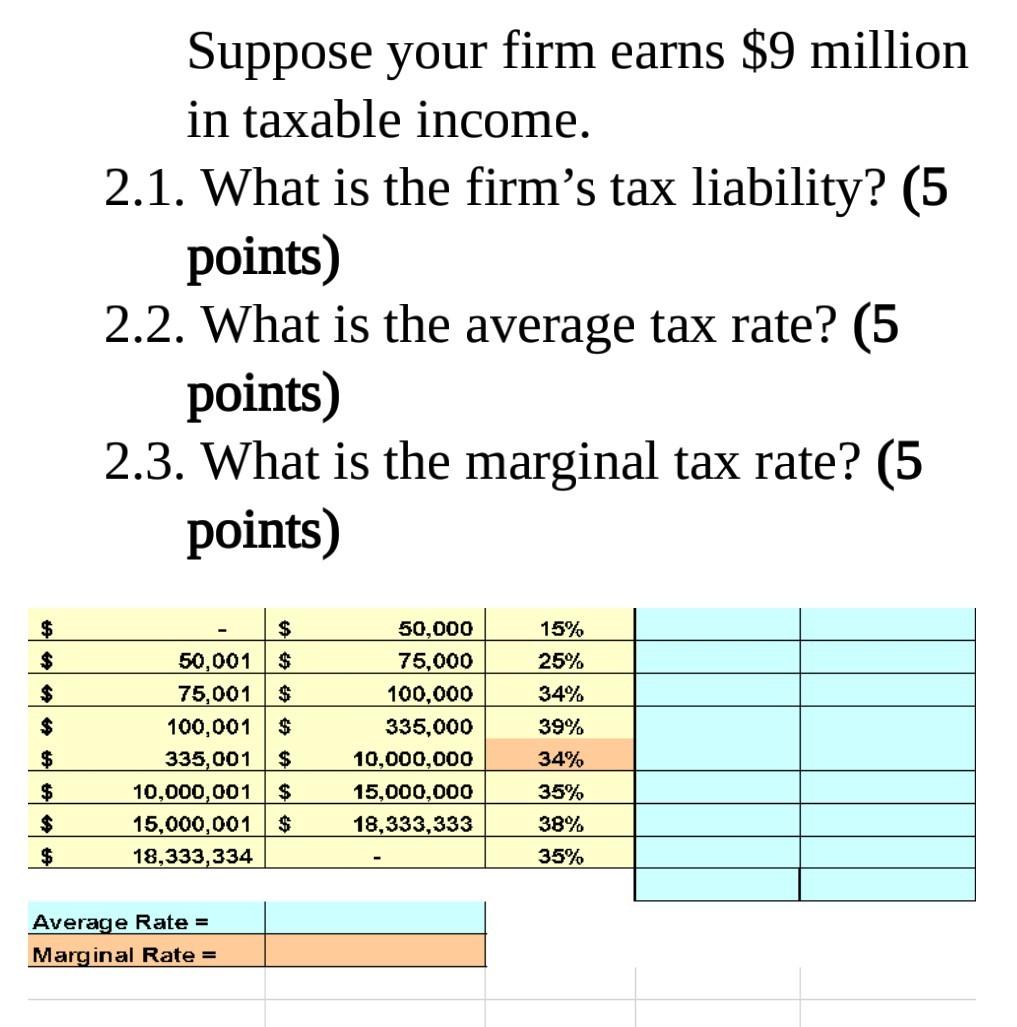

Suppose your firm earns $9 million in taxable income. 2.1. What is the firm's tax liability? (5 points) 2.2. What is the average tax rate? (5 points) 2.3. What is the marginal tax rate? (5 points) $ $ $ $ $ 50,001 $ 75,001 $ 100,001 $ 335,001 $ 10,000,001 $ 15,000,001 $ 18,333,334 50,000 75,000 100,000 335,000 10,000,000 15,000,000 18,333,333 15% 25% 34% 39% 34% 35% 38% 35% $ $ $ $ Average Rate = Marginal Rate =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts