Question: ***SOLVE BY USING A SIMULATION IN EXCEL, IF IT IS NOT SOLVED THIS WAS IT IS WRONG AND WILL BE DISLIKED PLEASE DONT COPY &

***SOLVE BY USING A SIMULATION IN EXCEL, IF IT IS NOT SOLVED THIS WAS IT IS WRONG AND WILL BE DISLIKED

***SOLVE BY USING A SIMULATION IN EXCEL, IF IT IS NOT SOLVED THIS WAS IT IS WRONG AND WILL BE DISLIKED

PLEASE DONT COPY & PASTE OTHER PEOPLES ANSWERS, THAT IS NOT WHAT I NEED

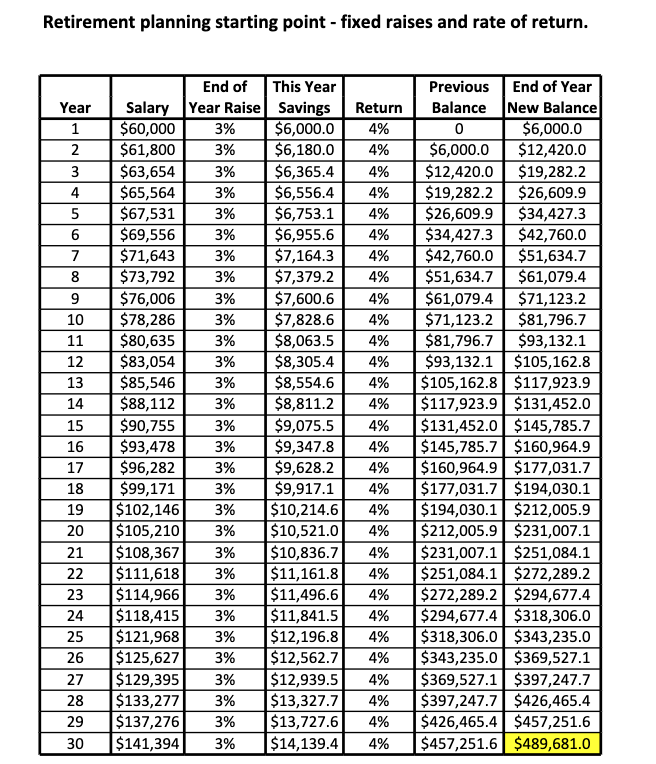

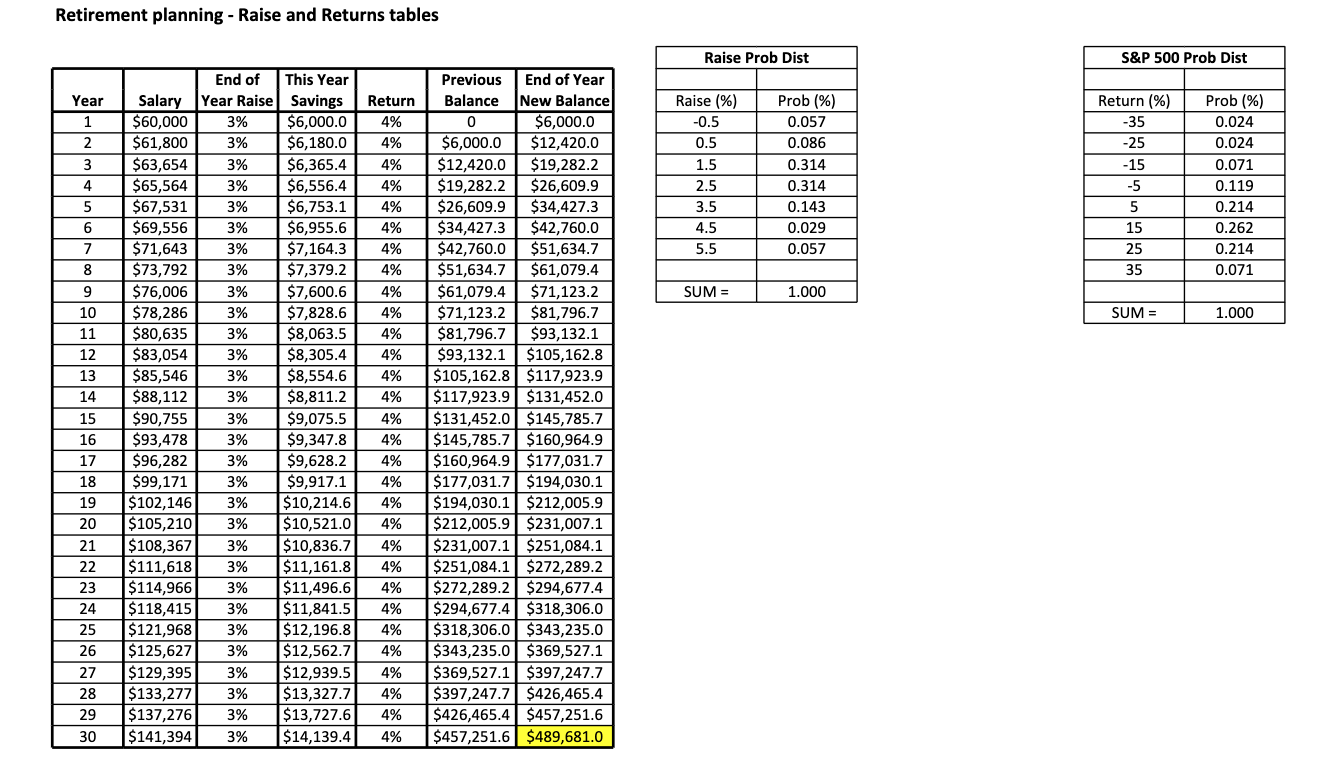

a. Using the retirement simulation spreadsheet that we created in class (based on file, "Retirement planning sim template," posted on Canvas), set the savings rate to 12.5% (instead of the 10% default value in the original simulation). Simulate 20030 -year careers. b. What percent of the time will the investment portfolio be worth more than $1,100,000 ? c. What is the probability that the portfolio will be worth less than $750,000? Retirement planning starting point - fixed raises and rate of return. Retirement planning - Raise and Returns tables a. Using the retirement simulation spreadsheet that we created in class (based on file, "Retirement planning sim template," posted on Canvas), set the savings rate to 12.5% (instead of the 10% default value in the original simulation). Simulate 20030 -year careers. b. What percent of the time will the investment portfolio be worth more than $1,100,000 ? c. What is the probability that the portfolio will be worth less than $750,000? Retirement planning starting point - fixed raises and rate of return. Retirement planning - Raise and Returns tables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts