Question: SOLVE COMPLETE PROBLEM = = = - Problem 2 (12 points). Consider a multi-period CRR model with T = 2, So = $20, u =

SOLVE COMPLETE PROBLEM

SOLVE COMPLETE PROBLEM

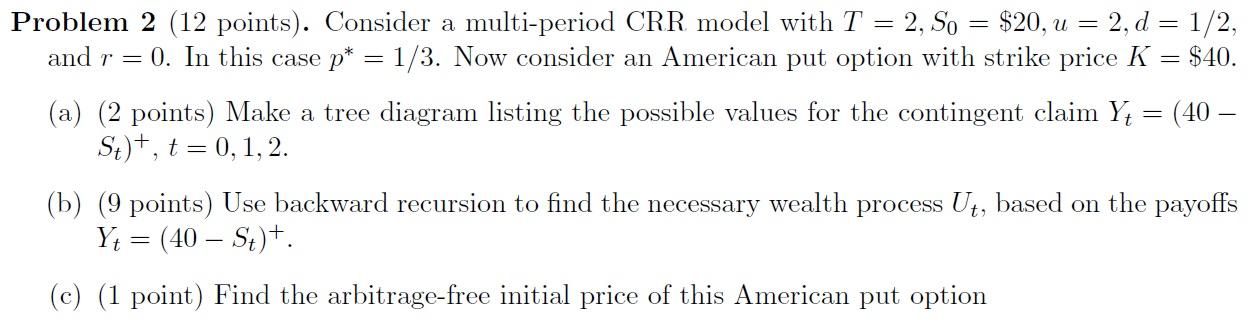

= = = - Problem 2 (12 points). Consider a multi-period CRR model with T = 2, So = $20, u = 2, d = 1/2, and r = 0. In this case p* = 1/3. Now consider an American put option with strike price K = $40. (a) (2 points) Make a tree diagram listing the possible values for the contingent claim Y4 = (40 St)+, t = 0,1,2. (b) (9 points) Use backward recursion to find the necessary wealth process Ut, based on the payoffs Yt = (40 St)+. . (c) (1 point) Find the arbitrage-free initial price of this American put option = = = - Problem 2 (12 points). Consider a multi-period CRR model with T = 2, So = $20, u = 2, d = 1/2, and r = 0. In this case p* = 1/3. Now consider an American put option with strike price K = $40. (a) (2 points) Make a tree diagram listing the possible values for the contingent claim Y4 = (40 St)+, t = 0,1,2. (b) (9 points) Use backward recursion to find the necessary wealth process Ut, based on the payoffs Yt = (40 St)+. . (c) (1 point) Find the arbitrage-free initial price of this American put option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts