Question: SOLVE THE PROBLEM. = Problem 1 (8 points). Consider the multi-period CRR model with T = 2, u = 2, d = 1, r =

SOLVE THE PROBLEM.

SOLVE THE PROBLEM.

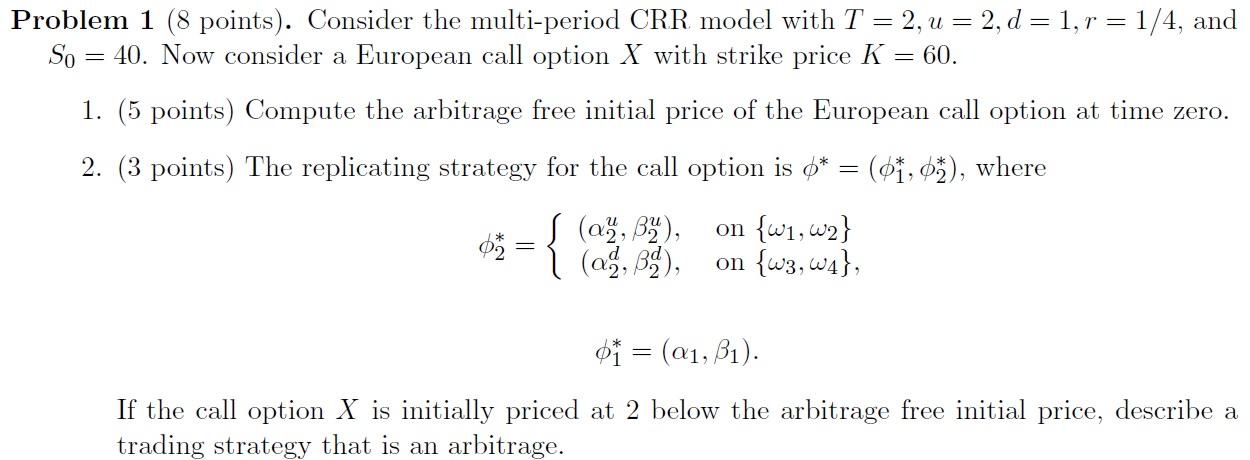

= Problem 1 (8 points). Consider the multi-period CRR model with T = 2, u = 2, d = 1, r = 1/4, and So = 40. Now consider a European call option X with strike price K = 60. 1. (5 points) Compute the arbitrage free initial price of the European call option at time zero. 2. (3 points) The replicating strategy for the call option is o* = (61,01), where o { (a, b), (a, b), on {w1,w2} on {w3,W4}, 01 = (a1, B1). If the call option X is initially priced at 2 below the arbitrage free initial price, describe a trading strategy that is an arbitrage. = Problem 1 (8 points). Consider the multi-period CRR model with T = 2, u = 2, d = 1, r = 1/4, and So = 40. Now consider a European call option X with strike price K = 60. 1. (5 points) Compute the arbitrage free initial price of the European call option at time zero. 2. (3 points) The replicating strategy for the call option is o* = (61,01), where o { (a, b), (a, b), on {w1,w2} on {w3,W4}, 01 = (a1, B1). If the call option X is initially priced at 2 below the arbitrage free initial price, describe a trading strategy that is an arbitrage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts