Question: Solve During its first year of operations, ABC Co. reported income before taxes of $550,000 and taxable income of $600,000. The difference was due solely

Solve

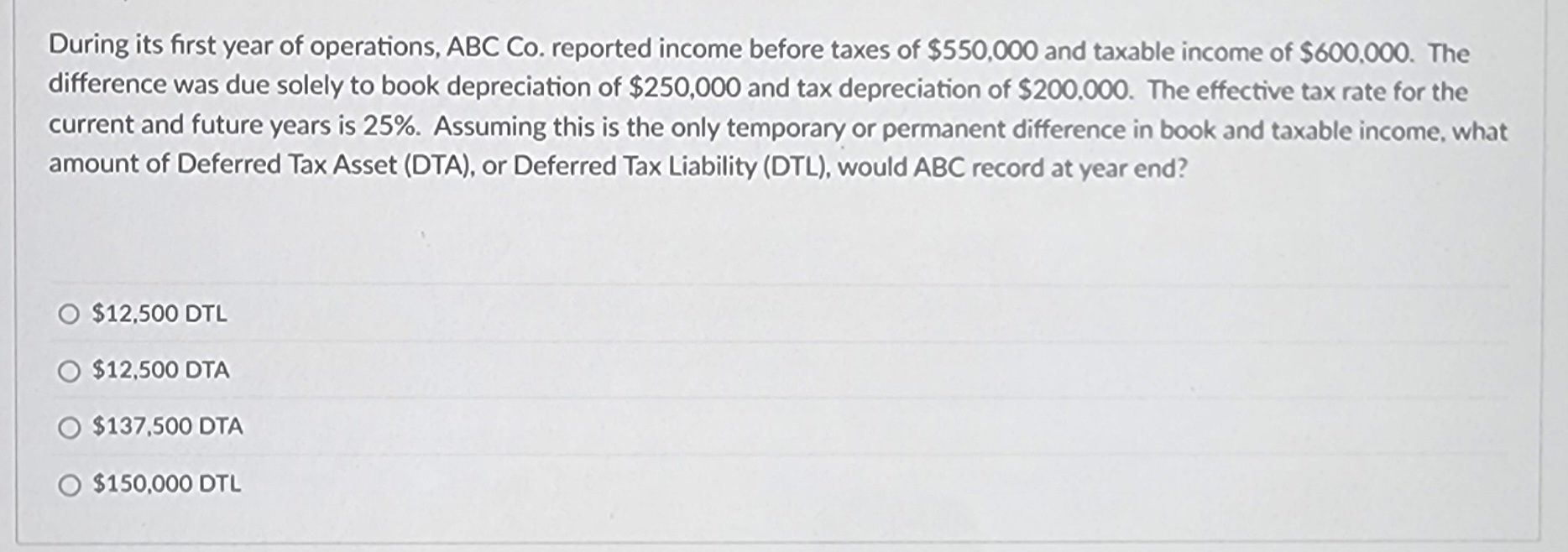

During its first year of operations, ABC Co. reported income before taxes of $550,000 and taxable income of $600,000. The difference was due solely to book depreciation of $250,000 and tax depreciation of $200,000. The effective tax rate for the current and future years is 25%. Assuming this is the only temporary or permanent difference in book and taxable income, what amount of Deferred Tax Asset (DTA), or Deferred Tax Liability (DTL), would ABC record at year end? O $12,500 DTL O $12,500 DTA O $137,500 DTA $150,000 DTL

During its first year of operations, ABC Co. reported income before taxes of $550,000 and taxable income of $600,000. The difference was due solely to book depreciation of $250,000 and tax depreciation of $200,000. The effective tax rate for the current and future years is 25%. Assuming this is the only temporary or permanent difference in book and taxable income, what amount of Deferred Tax Asset (DTA), or Deferred Tax Liability (DTL), would ABC record at year end? O $12,500 DTL O $12,500 DTA O $137,500 DTA $150,000 DTL Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock