Question: Solve Each and Every one. Part 3B (Questions 33-37): Based on the information below, prepare ABC Company's adjusting entries and closing entry on December 31,

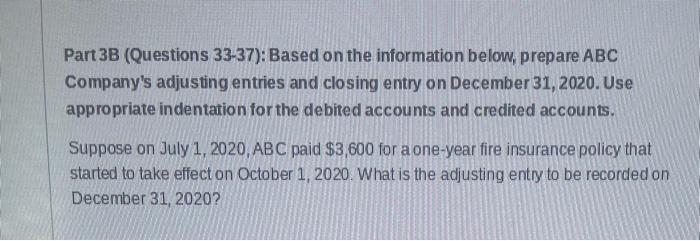

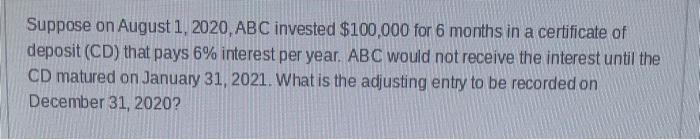

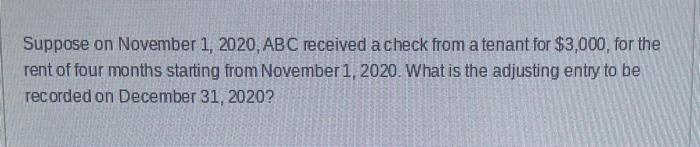

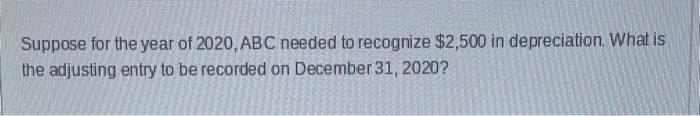

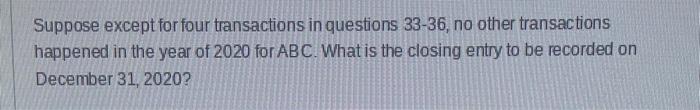

Part 3B (Questions 33-37): Based on the information below, prepare ABC Company's adjusting entries and closing entry on December 31, 2020. Use appropriate indentation for the debited accounts and credited accounts. Suppose on July 1, 2020, ABC paid $3,600 for a one-year fire insurance policy that started to take effect on October 1, 2020. What is the adjusting entry to be recorded on December 31, 2020? Suppose on August 1, 2020, ABC invested $100,000 for 6 months in a certificate of deposit (CD) that pays 6% interest per year. ABC would not receive the interest until the CD matured on January 31, 2021. What is the adjusting entry to be recorded on December 31, 2020? Suppose on November 1, 2020, ABC received a check from a tenant for $3,000, for the rent of four months starting from November 1, 2020. What is the adjusting entry to be recorded on December 31, 2020? Suppose for the year of 2020, ABC needed to recognize $2,500 in depreciation. What is the adjusting entry to be recorded on December 31, 2020? Suppose except for four transactions in questions 33-36, no other transactions happened in the year of 2020 for ABC. What is the closing entry to be recorded on December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts