Question: solve explain e Cash Flow was $330 8. The Internal Rate of Return rule cannot be relied upo A. when there are delayed investments B.

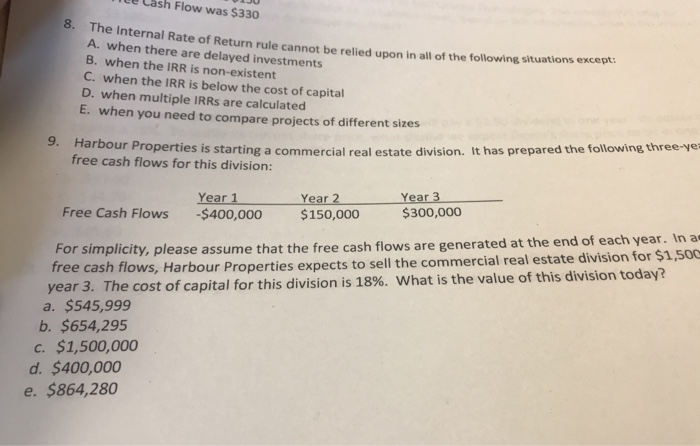

e Cash Flow was $330 8. The Internal Rate of Return rule cannot be relied upo A. when there are delayed investments B. when the IRR is non-existent C. when the IRR is below the cost of capital D. when multiple IRRs are calculated E. when you need to compare projects of different sizes n in all of the following situations e xce pt arbour Properties is starting a commercial real estate division. It has prepared the following three-ye free cash flows for this division: Year 1 Year 2Year 3 Free Cash Flows $400,000 $150,000 300,000 of each year. In a For simplicity, please assume that the free cash flows are generated at the end arbour Properties expects to sell the commercial real estate division for $1,500 years. The cost of capital for this division is 18%. What is the value of this division today? a. $545,999 b. $654,295 c. $1,500,000 d. $400,000 e. $864,280

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts