Question: solve for b (Related to Checkpoint 5.6) (Solving for Springfield Learning sold zoro coupon bonds (bonds that don't pay any interest, instead the bondholder gets

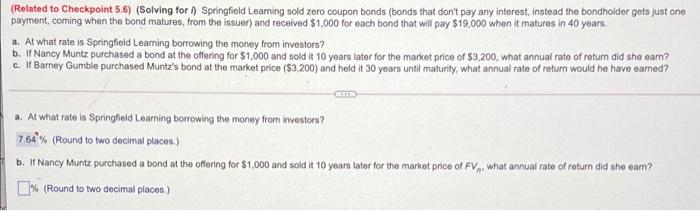

(Related to Checkpoint 5.6) (Solving for Springfield Learning sold zoro coupon bonds (bonds that don't pay any interest, instead the bondholder gets just one payment, coming when the bond matures, from the issuer) and received $1,000 for each bond that will pay $19,000 when it matures in 40 years. a. At what rate is Springfield Learning borrowing the money from investors? b. Nancy Muntz purchased a bond at the offering for $1,000 and sold it 10 years later for the market price of $3,200, what annual rate of retur did she earn? c. If Barney Gumble purchased Muntz's bond at the market price ($3,200) and held it 30 years until maturity, what annual rate of return would he have earned? a. At whatrate in Springfield Learning borrowing the money from investors? 764% (Round to two decimal places) b. If Nancy Muntz purchased a bond at the offering for $1,000 and sold it 10 years later for the market price of FV, what annual rate of return did she cam? % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts