Question: solve for question #4 using the answer from question #3 Q3. The Comer Bar & Grill is in the process of taking a 5-year loan

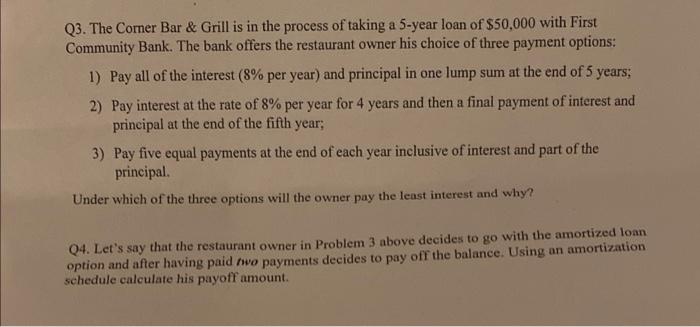

Q3. The Comer Bar \& Grill is in the process of taking a 5-year loan of $50,000 with First Community Bank. The bank offers the restaurant owner his choice of three payment options: 1) Pay all of the interest ( 8% per year) and principal in one lump sum at the end of 5 years; 2) Pay interest at the rate of 8% per year for 4 years and then a final payment of interest and principal at the end of the fifth year; 3) Pay five equal payments at the end of each year inclusive of interest and part of the principal. Under which of the three options will the owner pay the least interest and why? Q4. Let's say that the restaurant owner in Problem 3 above decides to go with the amortized loan option and after having paid hwo payments decides to pay off the balance. Using an amortization schedule calculate his payoff amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts