Question: solve in 25 mins i will give thumb up. write final answer at end of solution separately There are two discount bonds in the market

solve in 25 mins i will give thumb up. write final answer at end of solution separately

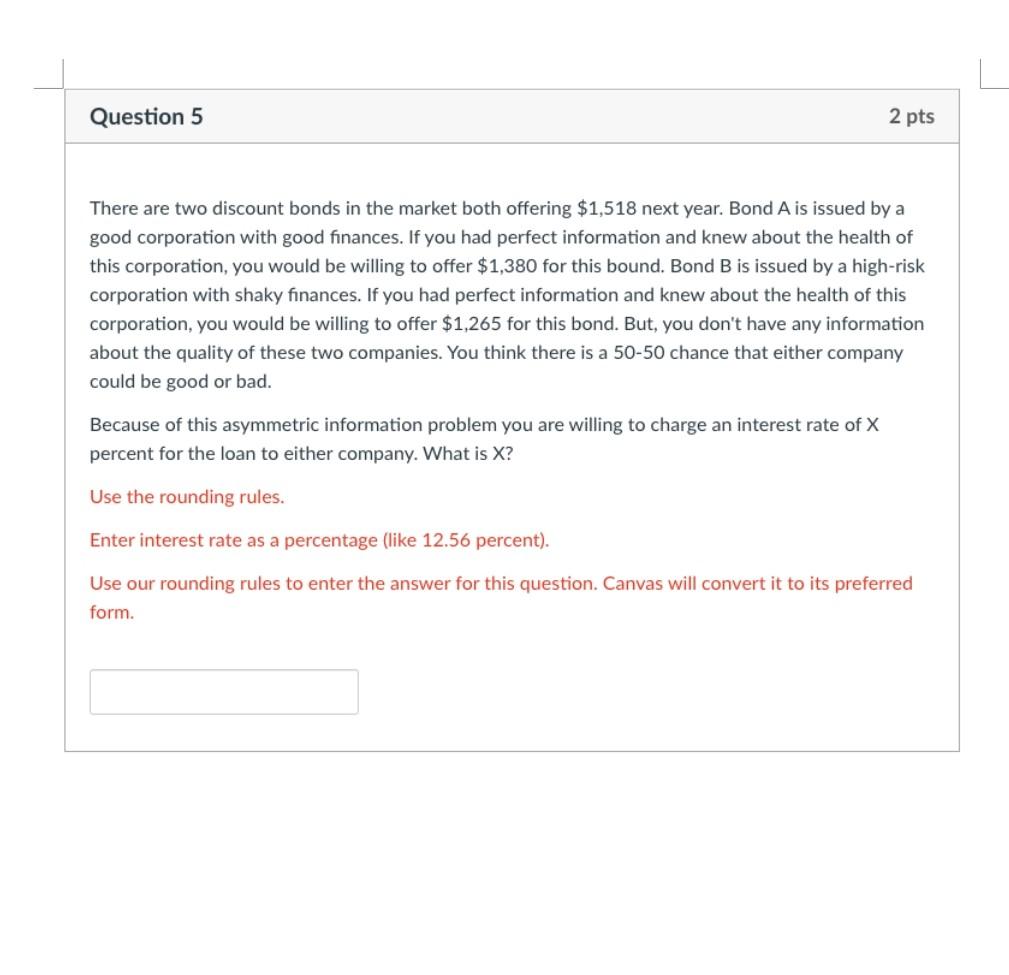

There are two discount bonds in the market both offering $1,518 next year. Bond A is issued by a good corporation with good finances. If you had perfect information and knew about the health of this corporation, you would be willing to offer $1,380 for this bound. Bond B is issued by a high-risk corporation with shaky finances. If you had perfect information and knew about the health of this corporation, you would be willing to offer $1,265 for this bond. But, you don't have any information about the quality of these two companies. You think there is a 50-50 chance that either company could be good or bad. Because of this asymmetric information problem you are willing to charge an interest rate of X percent for the loan to either company. What is X ? Use the rounding rules. Enter interest rate as a percentage (like 12.56 percent). Use our rounding rules to enter the answer for this question. Canvas will convert it to its preferred form

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts