Question: solve in 40 mins i will give thumb up 1 Problem 5 (10 marks) (20 minutes) 2 Frank & Dogg Construction Corporation obtained a $12,500,000

solve in 40 mins i will give thumb up

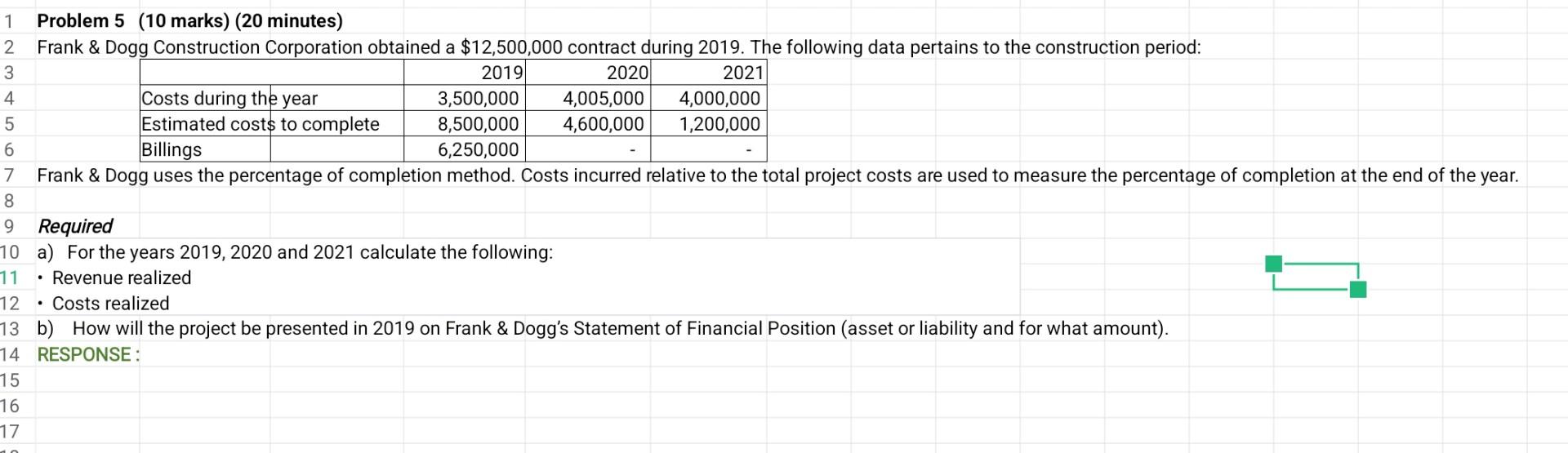

1 Problem 5 (10 marks) (20 minutes) 2 Frank \& Dogg Construction Corporation obtained a $12,500,000 contract during 2019. The following data pertains to the construction period: \begin{tabular}{|l|l|r|r|r|} \hline 3 & \multicolumn{1}{|l|}{2019} & 2020 & 2021 \\ \hline 4 & Costs during the year & 3,500,000 & 4,005,000 & 4,000,000 \\ \hline 5 & Estimated costs to complete & 8,500,000 & 4,600,000 & 1,200,000 \\ \hline 6 & Billings & 6,250,000 & & \\ \hline \end{tabular} Required a) For the years 2019, 2020 and 2021 calculate the following: - Revenue realized - Costs realized b) How will the project be presented in 2019 on Frank \& Dogg's Statement of Financial Position (asset or liability and for what amount). RESPONSE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts