Question: solve in 50 mins i will give thumb up. Q2) (0.3% ) Consider the market in which there are two securities: bond (a non risky

solve in 50 mins i will give thumb up.

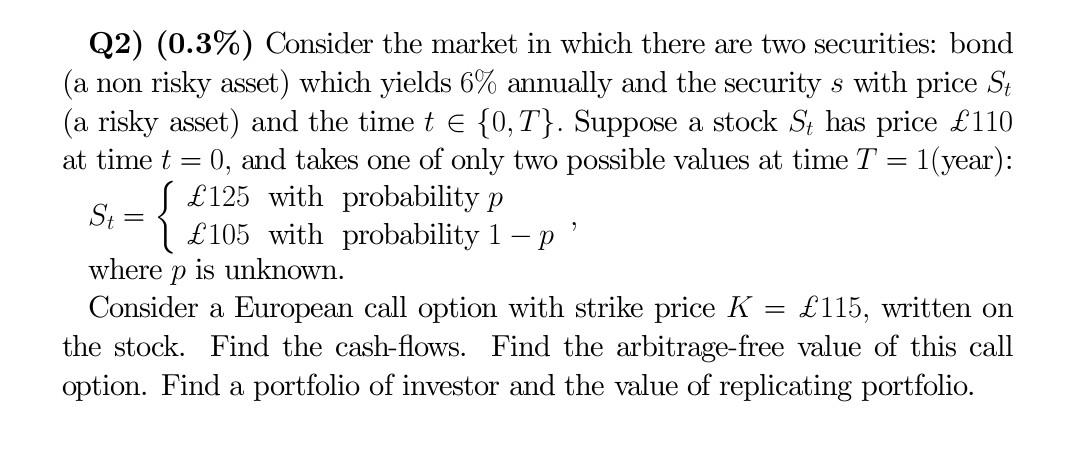

Q2) (0.3% ) Consider the market in which there are two securities: bond (a non risky asset) which yields 6% annually and the security s with price St (a risky asset) and the time t{0,T}. Suppose a stock St has price 110 at time t=0, and takes one of only two possible values at time T=1 (year): St={125withprobabilityp105withprobability1p, where p is unknown. Consider a European call option with strike price K=115, written on the stock. Find the cash-flows. Find the arbitrage-free value of this call option. Find a portfolio of investor and the value of replicating portfolio

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock