Question: solve in 60 mins thanks Q2) (0.3% ) Consider the market in which there are two securities: bond (a non risky asset) which yields 6%

solve in 60 mins thanks

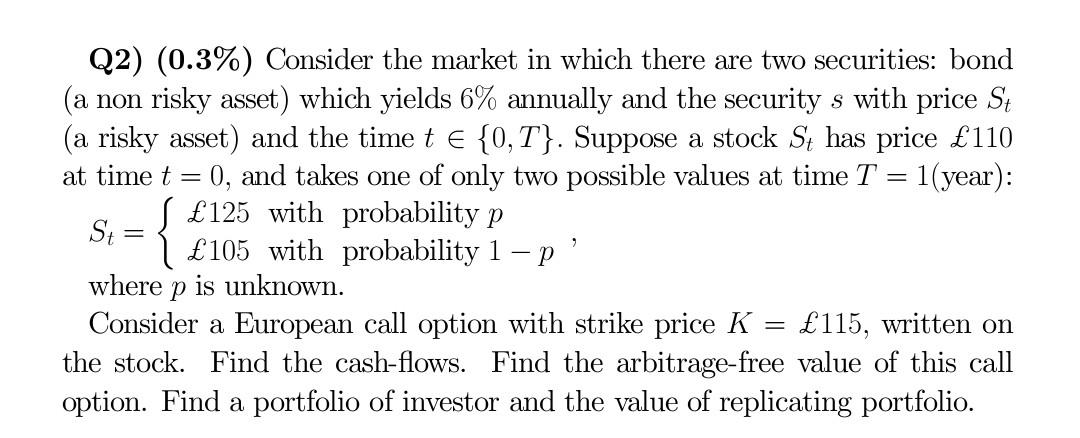

Q2) (0.3% ) Consider the market in which there are two securities: bond (a non risky asset) which yields 6% annually and the security s with price St (a risky asset) and the time t{0,T}. Suppose a stock St has price 110 at time t=0, and takes one of only two possible values at time T=1 (year): St={125withprobabilityp105withprobability1p, where p is unknown. Consider a European call option with strike price K=115, written on the stock. Find the cash-flows. Find the arbitrage-free value of this call option. Find a portfolio of investor and the value of replicating portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts