Question: SOLVE in EXCEL, go slow step by step pls Year Revenue Fixed costs Variable costs Add. investment in NWC Add. investment in operating long-term assets

SOLVE in EXCEL, go slow step by step pls

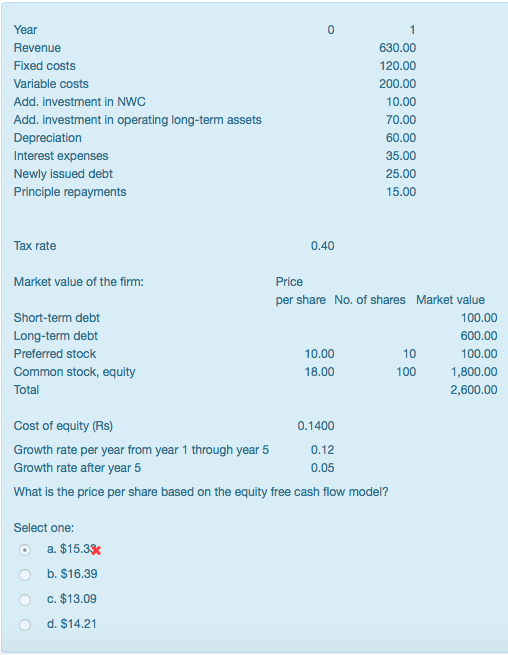

Year Revenue Fixed costs Variable costs Add. investment in NWC Add. investment in operating long-term assets Depreciation Interest expenses Newly issued debt Principle repayments 630.00 120.00 200.00 10.00 70.00 60.00 35.00 25.00 15.00 lax rate 0.40 Market value of the firm: Price per share No. of shares Market value Short-term debt Long-term debt Preferred stock Common stock, equity Total 100.00 600.00 100.00 1,800.00 2,600.00 10.00 18.00 10 100 Cost of equity (Rs) Growth rate per year from year 1 through year 5 Growth rate after year 5 What is the price per share based on the equity free cash flow model? 0.1400 0.12 0.05 Select one: a. $15.3x b. $16.39 c. $13.09 d. $14.21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts