Question: solve in Excel Question 4: Johnson and Johnson (JNJ), rated AAA by S&P, issues an 8-year $1000 par value bond that pays semiannual coupons. Coupon

solve in Excel

solve in Excel

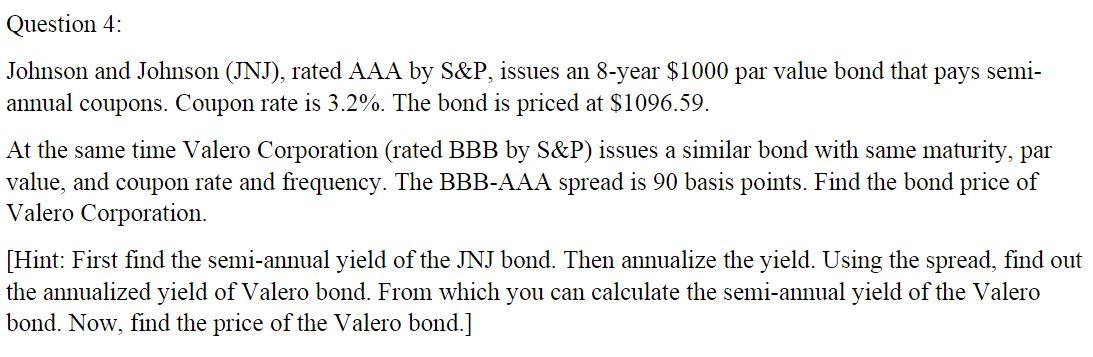

Question 4: Johnson and Johnson (JNJ), rated AAA by S\&P, issues an 8-year $1000 par value bond that pays semiannual coupons. Coupon rate is 3.2%. The bond is priced at $1096.59. At the same time Valero Corporation (rated BBB by S\&P) issues a similar bond with same maturity, par value, and coupon rate and frequency. The BBB-AAA spread is 90 basis points. Find the bond price of Valero Corporation. [Hint: First find the semi-annual yield of the JNJ bond. Then annualize the yield. Using the spread, find out the annualized yield of Valero bond. From which you can calculate the semi-annual yield of the Valero bond. Now, find the price of the Valero bond.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts