Question: Solve in Python. Question 2 (10 points) Using the single period log returns, we can arrive to a geometric random walk model: logP = x

Solve in Python.

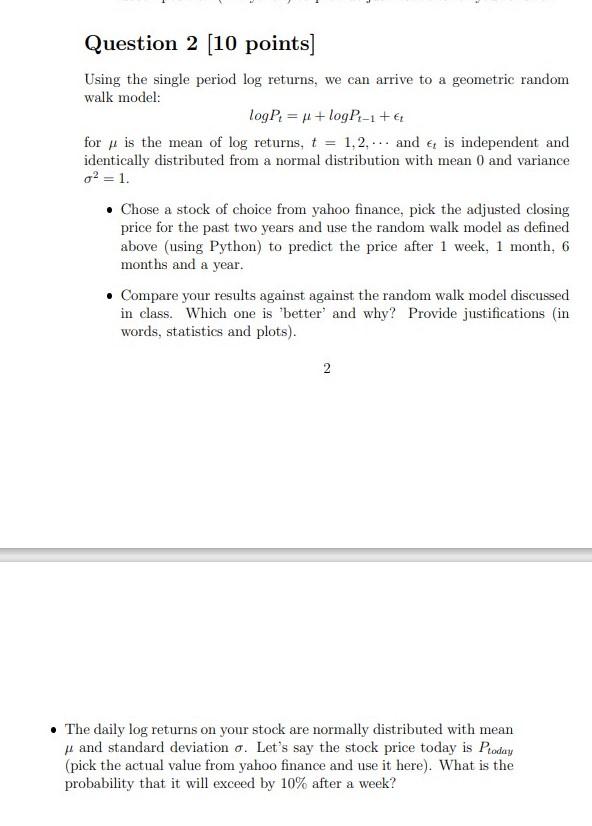

Question 2 (10 points) Using the single period log returns, we can arrive to a geometric random walk model: logP = x + logPa-1 + Et for p is the mean of log returns, t = 1.2. ... and is independent and identically distributed from a normal distribution with mean 0 and variance g? =1. Chose a stock of choice from yahoo finance, pick the adjusted closing price for the past two years and use the random walk model as defined above (using Python) to predict the price after 1 week, 1 month, 6 months and a year. Compare your results against against the random walk model discussed in class. Which one is 'better and why? Provide justifications (in words, statistics and plots). 2 The daily log returns on your stock are normally distributed with mean H and standard deviation o. Let's say the stock price today is Proday (pick the actual value from yahoo finance and use it here). What is the probability that it will exceed by 10% after a week? Question 2 (10 points) Using the single period log returns, we can arrive to a geometric random walk model: logP = x + logPa-1 + Et for p is the mean of log returns, t = 1.2. ... and is independent and identically distributed from a normal distribution with mean 0 and variance g? =1. Chose a stock of choice from yahoo finance, pick the adjusted closing price for the past two years and use the random walk model as defined above (using Python) to predict the price after 1 week, 1 month, 6 months and a year. Compare your results against against the random walk model discussed in class. Which one is 'better and why? Provide justifications (in words, statistics and plots). 2 The daily log returns on your stock are normally distributed with mean H and standard deviation o. Let's say the stock price today is Proday (pick the actual value from yahoo finance and use it here). What is the probability that it will exceed by 10% after a week

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts