Question: solve please Question 1 (5 marks): Assume you are the finance manager of Almanor Company, and the company is considering investing in one of the

solve please

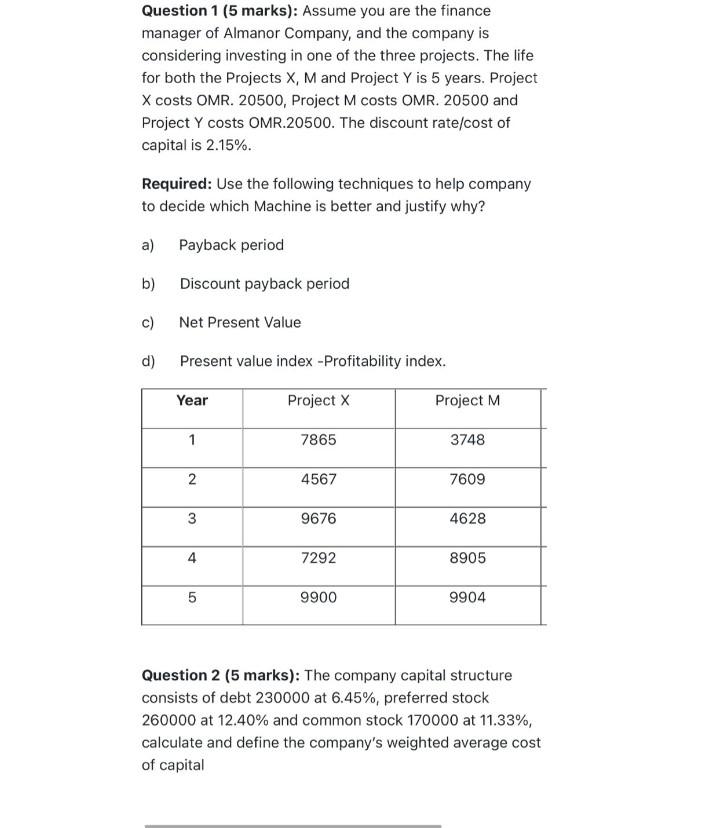

Question 1 (5 marks): Assume you are the finance manager of Almanor Company, and the company is considering investing in one of the three projects. The life for both the Projects X, M and Project Y is 5 years. Project X costs OMR. 20500, Project M costs OMR. 20500 and Project Y costs OMR.20500. The discount rate/cost of capital is 2.15%. Required: Use the following techniques to help company to decide which Machine is better and justify why? a) Payback period b) Discount payback period c) Net Present Value d) Present value index -Profitability index. Year Project X Project M 7865 3748 2 4567 7609 3 9676 4628 4 7292 8905 5 9900 9904 Question 2 (5 marks): The company capital structure consists of debt 230000 at 6.45%, preferred stock 260000 at 12.40% and common stock 170000 at 11.33%, calculate and define the company's weighted average cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts