Question: solve please,( this is one schedual!) The TimpRiders LP has operated a motorcycle dealership for a number of years. Lance is the limited partner, Francescais

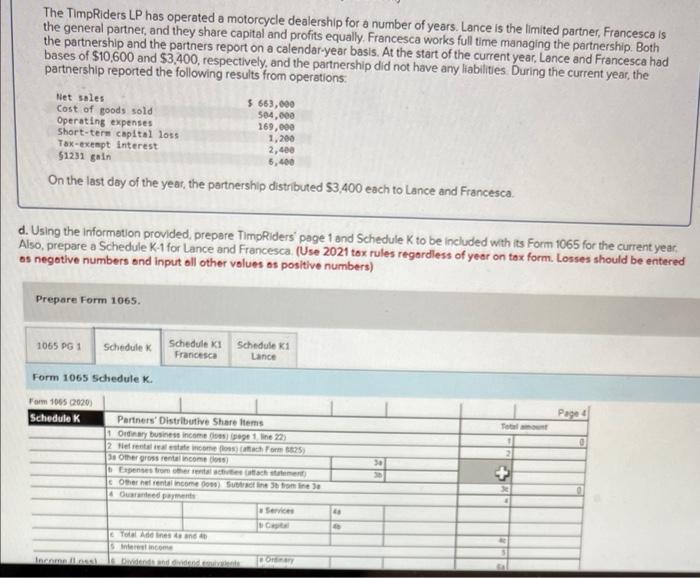

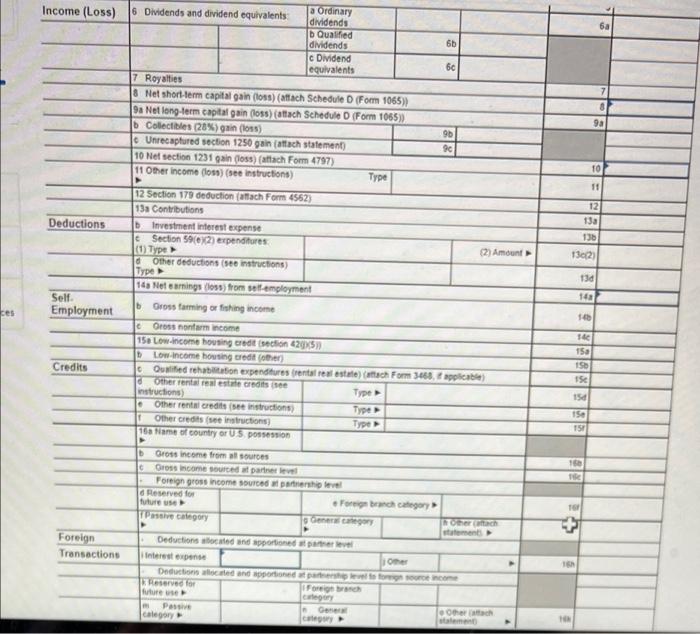

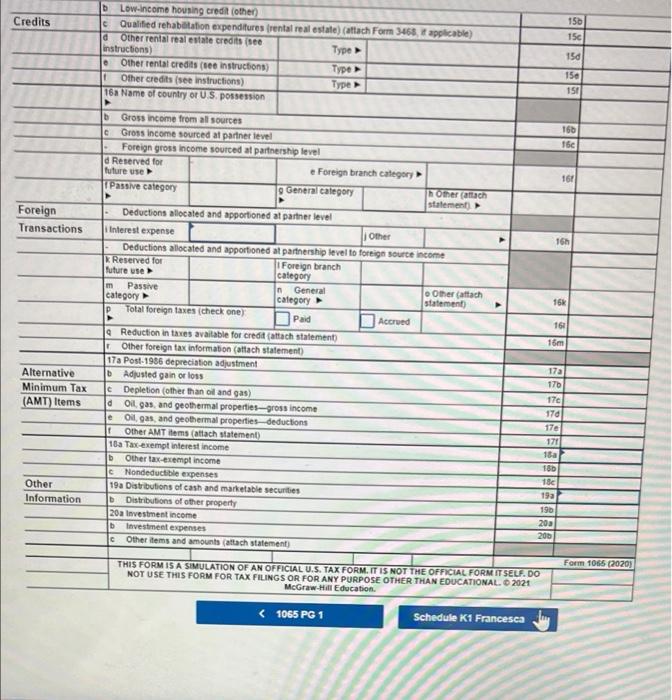

The TimpRiders LP has operated a motorcycle dealership for a number of years. Lance is the limited partner, Francescais the general partner, and they share capital and profits equally. Francesca works full time managing the partnership. Both the partnership and the partners report on a calendar-year basis. At the start of the current year, Lance and Francesca had bases of $10,600 and $3,400, respectively, and the partnership did not have any liabilities During the current year, the partnership reported the following results from operations: Net sales $ 663,000 Cost of goods sold 504,000 Operating expenses 169,000 Short-term capital loss 1,200 Tax-exempt interest 2,400 51231 gain 5,400 On the last day of the year, the partnership distributed $3,400 each to Lance and Francesca d. Using the information provided, prepare TimpRiders' page 1 and Schedule K to be included with its Form 1065 for the current year, Also, prepare a Schedule K-1 for Lance and Francesca. (Use 2021 tox rules regardless of year on tax form. Losses should be entered os negative numbers and input all other volues os positive numbers) Prepare Form 1065 1065 PG1 Schedule Schedule Ki Francesca Schedule 1 Lance Form 1065 Schedule K. Form 1085 020) Schedule Partners Distributive Share Items Ordinary business income 1 line 22) 2 Refrente come acho 1825) 38 Omer gross rental income Page 4 0 30 + Omer nel rental income 0000) Surominee dan Services Toines en Interest income DO Income (Loss) 6a 6b 6 Dividends and dividend equivalents a Ordinary dividends b Qualified dividends c Dividend equivalents 7 Royalties 8 Net short-term capital gain (loss) tach Schedule D (Form 1065)) 9 Net long-term capital gain (loss) (attach Schedule D (Form 1065)) b Collectibles (20%)gain (los) Unrecaptured section 1250 gain (attach statement) 10 Net section 1231 gain (los)[attach Form 4797) 11 Other income (s) (see instructions) Type 7 8 9a 90 9c 10 11 12 Deductions 13a 130 1302) 130 14 Self Employment ces 12 Section 179 deduction (attach Form 4562) 131 Contributions Investment interest Expense Section 592) erpenditures (1) Type 82) Amount Other deductions (see instructions) Type 149 Net Garnings (103) from all employment bross farming or fishing income cross nanam income 150 Low-income housing creditelon 2015 D Low.income housing credite cuified rehabilitation expenditures rental real estate) (tach Form 3468. applicat Other entre este credite instructions) Type Other rental credits see instructions Type Other cresce instructions Type 10 me country or US DOSSO | || 19 T&C 15 Credits 15 150 e 150 TS 160 TR 16 Foreign Transactions Gross income from all sources Gross income sourced apartine level Foreign gross income sourced water level Reserved for future use Forch category Passive Galegory 1 Geners or Other ach statement Deductions cated and portioned arvel rest Deduction and person Reserved for Freigh future use Category Passive Other category cy sta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts