Question: solve problem 3? they are all related to problem 1 but only solve problem 3. thanks Problem 1. (20 Points) The S/Espot exchange rate in

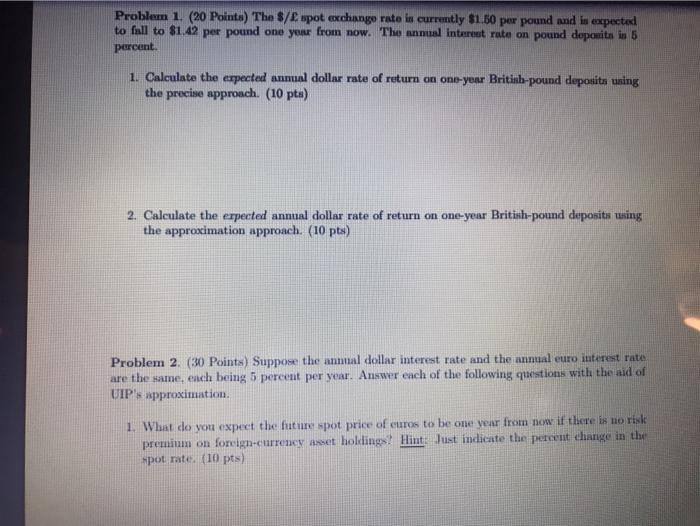

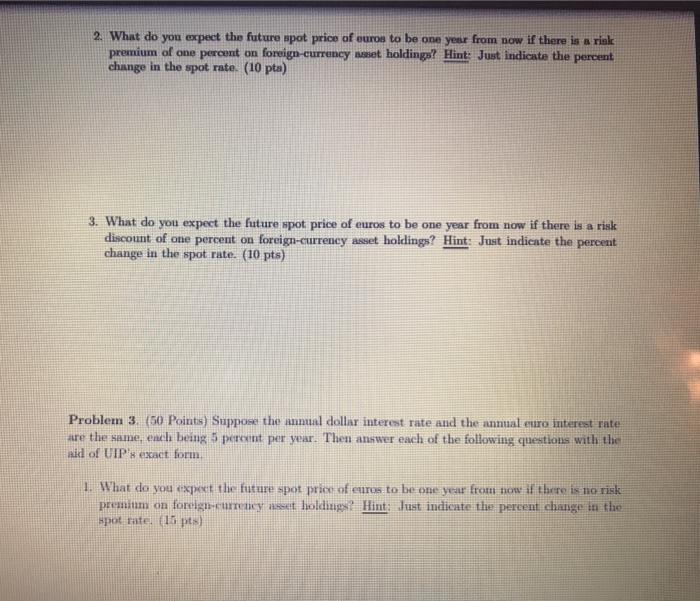

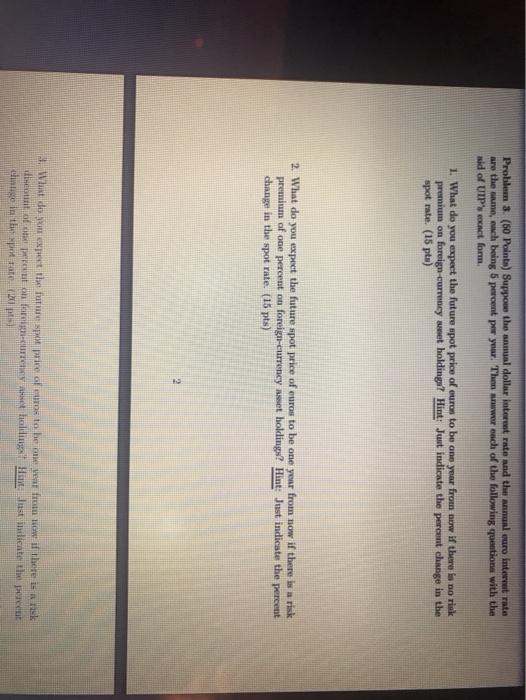

Problem 1. (20 Points) The S/Espot exchange rate in currently $1.50 per pound and in expected to full to $1.42 per pound one year from now. The annual interest rate on pound doposita in 5 percent. 1. Calculate the expected annual dollar rate of return on one-year British-pound deposits using the precise approach. (10 pta) 2. Calculate the erpected annual dollar rate of return on one-year British-pound deposits using the approximation approach. (10 pts) Problem 2. (30 Points) Suppose the annual dollar interest rate and the annual euro interest rate are the same, ench being 5 percent per year. Answer each of the following questions with the aid of UIP's approximation. 1. What do you expect the future spot price of euros to be one year from now if there is no risk premium on foreign-currency at holdings! Hint: Just indicate the percent change in the pot rate (10 pts) 2. What do you expect the future spot price of euros to be one year from now if there is a rink premium of one percent on foreign currency asset holdingo? Hint: Just indicate the percent change in the spot rate. (10 pta) 3. What do you expect the future spot price of euros to be one year from now if there is a risk discount of one percent on foreign-currency asset holdings? Hint: Just indicate the percent change in the spot rate. (10 pts) Problem 3. (50 Points) Suppose the annual dollar interest rate and the annual euro interest rate are the same, each being 5 perent per year. Then answer each of the following questions with the aid of UIP exact form 1. What do you expect the future spot prior of euros to be one year from now if there is no risk premium on foreign currency set holdings Hint: Just indicate the percent change in the spot rate (15 pts) Problem 3. (50 Points) Suppose the amal dollar interest rate and the manual muro interest rate are the same, each being 5 percent per year. Then anwww each of the following questions with the aid of UIP'act form, 1. What do you expect the future spot price of ourow to be one year from now if there is no risk premium on foreign currency wet holdingi? Hint: Just indicate the percent change in the spot rate. (15 pts) 2. What do you expect the future spot price of euros to be one year from now if there is a risk premium of one percent on foreign-currency Aset holding? Hint: Just indicate the percent change in the spot rate. (15 pta) 2 Whit des expect the future spor price al cors to be one year from now if there is ank discontrato de holdig! Hitlust indiente the percent clintis in pot rates Problem 1. (20 Points) The S/Espot exchange rate in currently $1.50 per pound and in expected to full to $1.42 per pound one year from now. The annual interest rate on pound doposita in 5 percent. 1. Calculate the expected annual dollar rate of return on one-year British-pound deposits using the precise approach. (10 pta) 2. Calculate the erpected annual dollar rate of return on one-year British-pound deposits using the approximation approach. (10 pts) Problem 2. (30 Points) Suppose the annual dollar interest rate and the annual euro interest rate are the same, ench being 5 percent per year. Answer each of the following questions with the aid of UIP's approximation. 1. What do you expect the future spot price of euros to be one year from now if there is no risk premium on foreign-currency at holdings! Hint: Just indicate the percent change in the pot rate (10 pts) 2. What do you expect the future spot price of euros to be one year from now if there is a rink premium of one percent on foreign currency asset holdingo? Hint: Just indicate the percent change in the spot rate. (10 pta) 3. What do you expect the future spot price of euros to be one year from now if there is a risk discount of one percent on foreign-currency asset holdings? Hint: Just indicate the percent change in the spot rate. (10 pts) Problem 3. (50 Points) Suppose the annual dollar interest rate and the annual euro interest rate are the same, each being 5 perent per year. Then answer each of the following questions with the aid of UIP exact form 1. What do you expect the future spot prior of euros to be one year from now if there is no risk premium on foreign currency set holdings Hint: Just indicate the percent change in the spot rate (15 pts) Problem 3. (50 Points) Suppose the amal dollar interest rate and the manual muro interest rate are the same, each being 5 percent per year. Then anwww each of the following questions with the aid of UIP'act form, 1. What do you expect the future spot price of ourow to be one year from now if there is no risk premium on foreign currency wet holdingi? Hint: Just indicate the percent change in the spot rate. (15 pts) 2. What do you expect the future spot price of euros to be one year from now if there is a risk premium of one percent on foreign-currency Aset holding? Hint: Just indicate the percent change in the spot rate. (15 pta) 2 Whit des expect the future spor price al cors to be one year from now if there is ank discontrato de holdig! Hitlust indiente the percent clintis in pot rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts