Question: Solve Problem 4 Using the posted R script as a starting point, implement the binomial tree option pricing algorithm for European options. 1. Consider a

Solve Problem 4

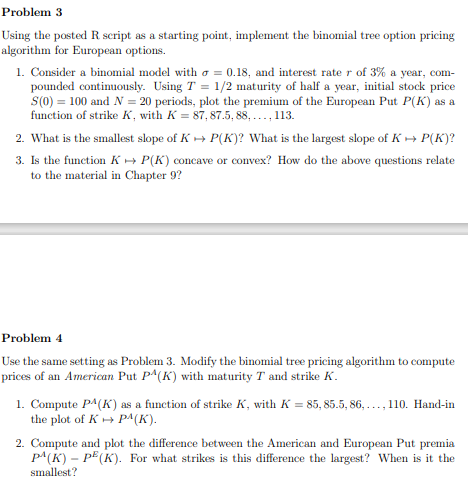

Using the posted R script as a starting point, implement the binomial tree option pricing algorithm for European options. 1. Consider a binomial model with =0.18, and interest rate r of 3% a year, compounded continuously. Using T=1/2 maturity of half a year, initial stock price S(0)=100 and N=20 periods, plot the premium of the European Put P(K) as a function of strike K, with K=87,87.5,88,,113. 2. What is the smallest slope of KP(K) ? What is the largest slope of KP(K) ? 3. Is the function KP(K) concave or convex? How do the above questions relate to the material in Chapter 9 ? Problem 4 Use the same setting as Problem 3 . Modify the binomial tree pricing algorithm to compute prices of an American Put PA(K) with maturity T and strike K. 1. Compute PA(K) as a function of strike K, with K=85,85.5,86,,110. Hand-in the plot of KPA(K). 2. Compute and plot the difference between the American and European Put premia PA(K)PE(K). For what strikes is this difference the largest? When is it the smallest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts