Question: Using the posted R script as a starting point, implement the binomial tree option pricing algorithm for European options. 1. Consider a binomial model with

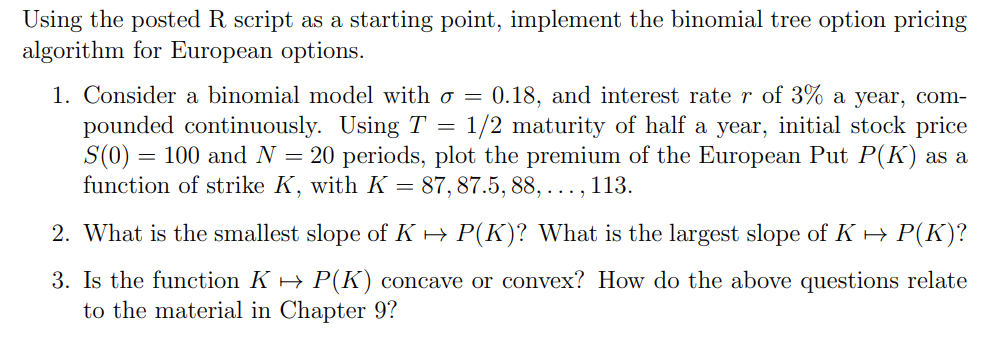

Using the posted R script as a starting point, implement the binomial tree option pricing algorithm for European options. 1. Consider a binomial model with =0.18, and interest rate r of 3% a year, compounded continuously. Using T=1/2 maturity of half a year, initial stock price S(0)=100 and N=20 periods, plot the premium of the European Put P(K) as a function of strike K, with K=87,87.5,88,,113. 2. What is the smallest slope of KP(K) ? What is the largest slope of KP(K) ? 3. Is the function KP(K) concave or convex? How do the above questions relate to the material in Chapter 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts