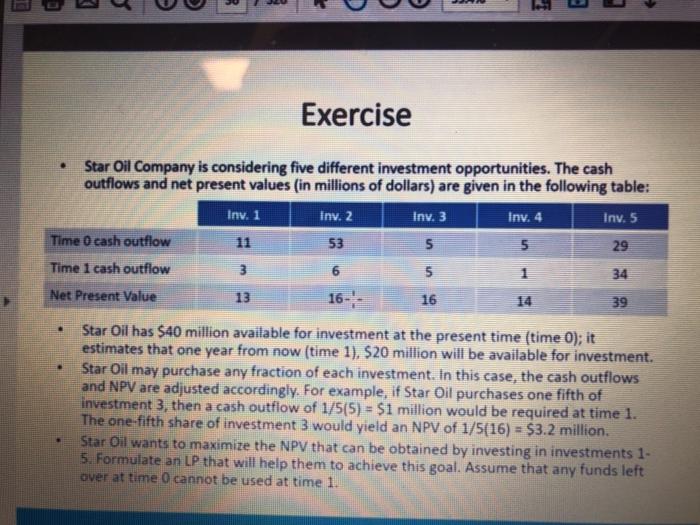

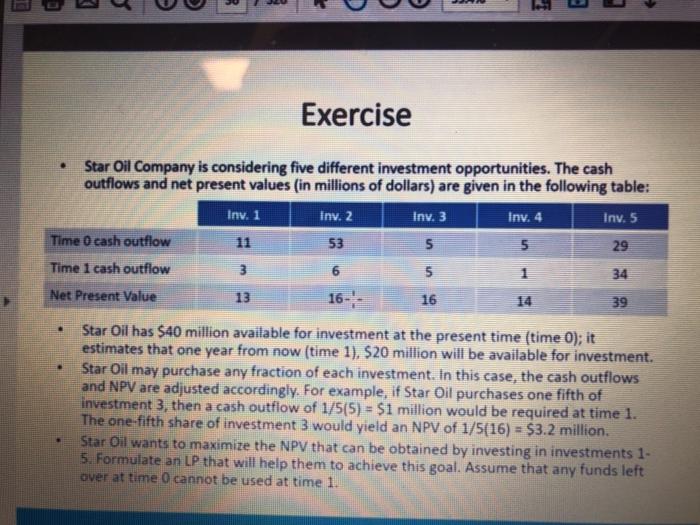

Question: solve problem completely please thanks in advance Exercise . Star Oil Company is considering five different investment opportunities. The cash outflows and net present values

solve problem completely please thanks in advance

Exercise . Star Oil Company is considering five different investment opportunities. The cash outflows and net present values (in millions of dollars) are given in the following table: Inv. 1 Inv. 2 Inv. 3 Inv. 4 Inv. 5 Time 0 cash outflow 53 5 5 29 Time 1 cash outflow 3 5 1 34 Net Present Value 13 16- 16 14 39 Star Oil has $40 million available for investment at the present time (time 0); it estimates that one year from now (time 1), $20 million will be available for investment. Star Oil may purchase any fraction of each investment. In this case, the cash outflows and NPV are adjusted accordingly. For example, if Star Oil purchases one fifth of investment 3, then a cash outflow of 1/5(5) = $1 million would be required at time 1. The one-fifth share of investment 3 would yield an NPV of 1/5(16) = $3.2 million. Star Oil wants to maximize the NPV that can be obtained by investing in investments 1- 5. Formulate an LP that will help them to achieve this goal. Assume that any funds left over at time 0 cannot be used at time 1

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock