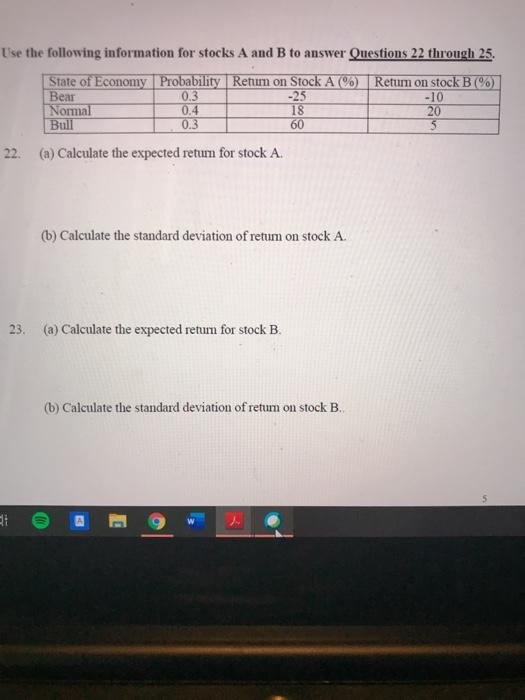

Question: solve problem, show equation and process. NO EXCEL Use the following information for stocks A and B to answer Questions 22 through 25. State of

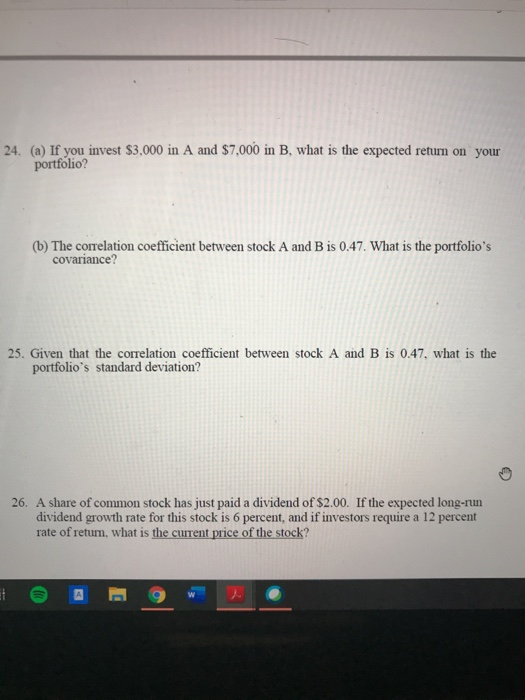

Use the following information for stocks A and B to answer Questions 22 through 25. State of Economy Probability Return on Stock A %) Return on stock B (%) Bear 0.3 -10 L Normal 0.4 18 20 Bull 0.3 60 S -25 22. (a) Calculate the expected retum for stock A. (b) Calculate the standard deviation of retum on stock A. 23. (a) Calculate the expected return for stock B. (b) Calculate the standard deviation of return on stock B. 24. (a) If you invest $3,000 in A and $7,000 in B. what is the expected return on your portfolio? (b) The correlation coefficient between stock A and B is 0.47. What is the portfolio's covariance? 25. Given that the correlation coefficient between stock A and B is 0.47, what is the portfolio's standard deviation? 26. A share of common stock has just paid a dividend of $2.00. If the expected long-run dividend growth rate for this stock is 6 percent, and if investors require a 12 percent rate of retum, what is the current price of the stock? 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts