Question: Solve step by step and include formulas. Thank you Question (40% ) The company is considering a five-year project that will require $738,000 for new

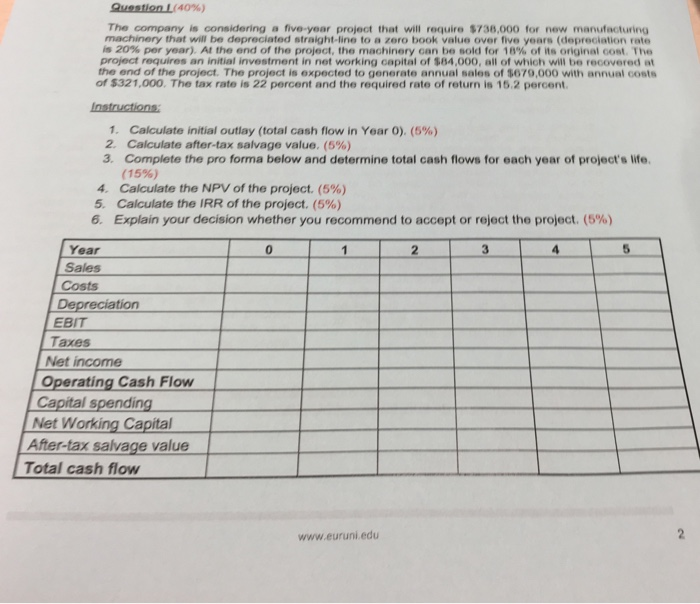

Question (40% ) The company is considering a five-year project that will require $738,000 for new manufacturing machinery that will be depreciated straight-line to a zero book value over five years (depreciation rate is 20% per year). At the end of the project, the machinery can be sold for 18% of its original cost. The project requires an initial investment in net working capital of $84,000, all of which will be recovered at the end of the project. The project is expected to generate annual sales of $679,000 with annual costs of $321,000. The tax rate is 22 percent and the required rate of return is 15.2 percent. Instructions 1 Calculate initial outlay (total cash flow in Year 0). (5 %) 2. Calculate after-tax salvage value. (5 % ) 3. Complete the pro forma below and determine total cash flows for each year of project's life. (15%) Calculate the NPV of the project. (5 %) 5. Calculate the IRR of the project. (5 %) 6. Explain your decision whether you recommend to accept or reject the project. (5 %) 4. 5 3 Year 1 4 Sales Costs Depreciation EBIT Taxes Net income Operating Cash Flow Capital spending Net Working Capital After-tax salvage value Total cash flow www.euruni.edu

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts