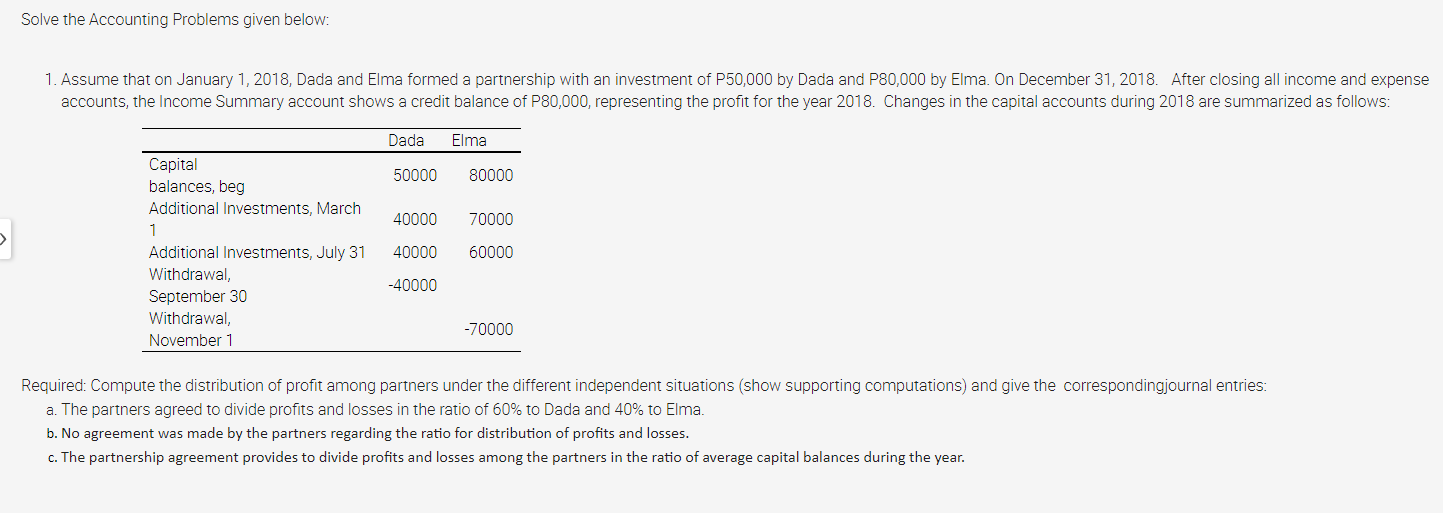

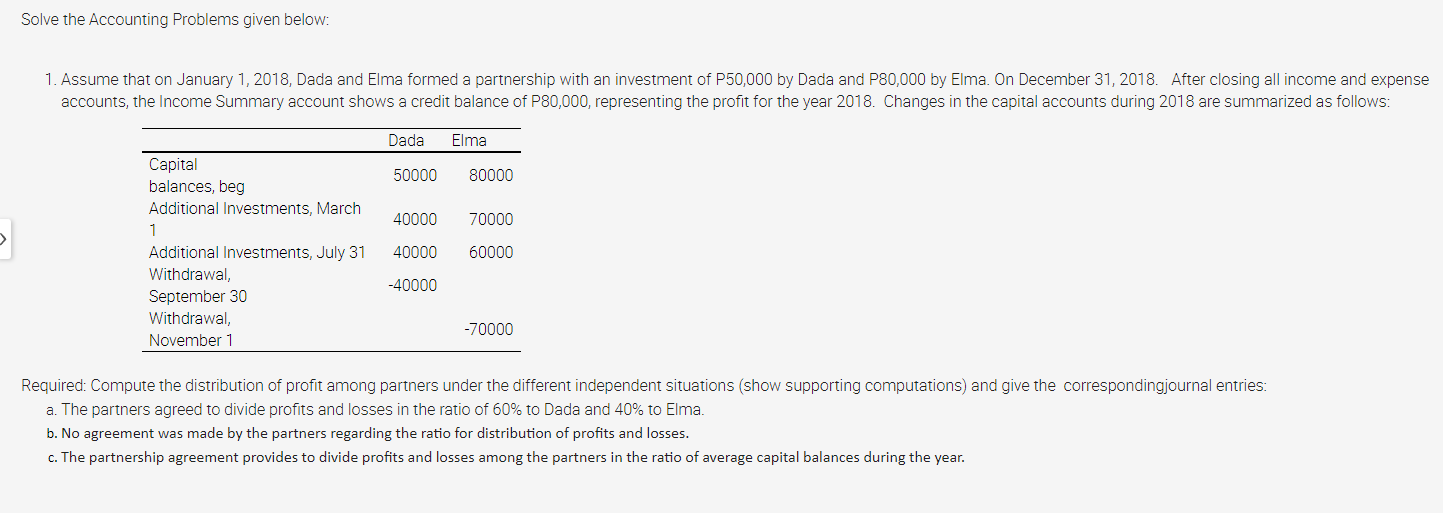

Question: Solve the Accounting Problems given below 1. Assume that on January 1, 2018, Dada and Elma formed a partnership With an investment of P501000 by

Solve the Accounting Problems given below 1. Assume that on January 1, 2018, Dada and Elma formed a partnership With an investment of P501000 by Dada and P80,000 by Elma. On December 311 2018. After closing all income and expense accounts the Income Summary account shows a credit balance of P80,000, representing the prot for the year 2018. Changes in the capital accounts during 2018 are summarized as follows: Dada Elma Capital balances, beg Additional Investments, March 1 Additional Investments, July 31 40000 60000 Withdrawal, September 30 Withdrawal, November 1 50000 80000 40000 70000 40000 770000 Required: Compute the distribution of prot among partners under the different independent situations (show supporting computations) and give the correspondingioumal entries: at. The partners agreed to divide prots and losses in the ratio of 60% to Dada and 40% to Elma. b. No agreement was made bvthe partners regarding the ratio for distribu'h'on of prots and losses. c. The partnership agreement provides to divide prots and losses among the partners in the ra'h'o of average capital balances during the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts