Question: Solve the following: Problem 1 In the table below, you see the data on four Wal-Mart call options, recorded on 4/13/20. All options expire May

Solve the following:

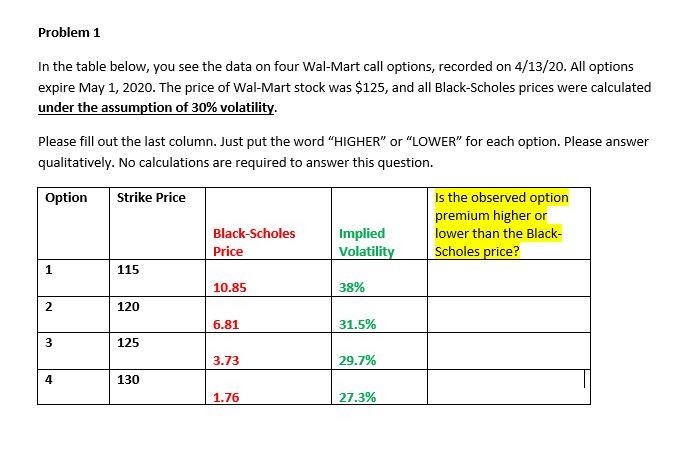

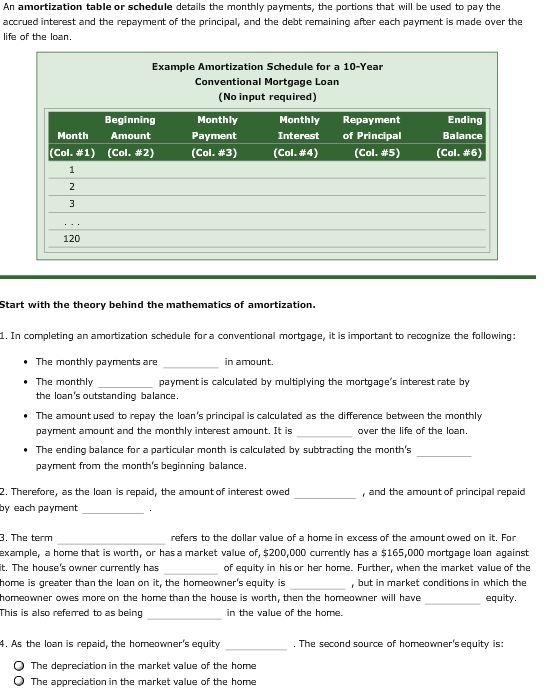

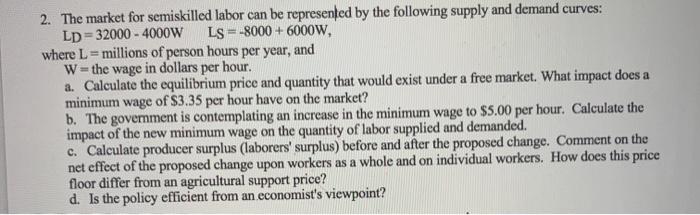

Problem 1 In the table below, you see the data on four Wal-Mart call options, recorded on 4/13/20. All options expire May 1, 2020. The price of Wal-Mart stock was $125, and all Black-Scholes prices were calculated under the assumption of 30% volatility. Please fill out the last column. Just put the word "HIGHER" or "LOWER" for each option. Please answer qualitatively. No calculations are required to answer this question. Option Strike Price Is the observed option premium higher or Black-Scholes Implied lower than the Black- Price Volatility Scholes price? 1 115 10.85 38% 2 120 6.81 31.5% 3 125 3.73 29.7% 4 130 1.76 27.3%An amortization table or schedule details the monthly payments, the portions that will be used to pay the accrued interest and the repayment of the principal, and the debt remaining after each payment is made over the life of the loan. Example Amortization Schedule for a 10-Year Conventional Mortgage Loan ( No input required) Beginning Monthly Monthly Repayment Ending Month Amount Payment Interest of Principal Balance (Col. #1) (Col. #2) (Col. #3) (Col. #4) (Col. #5) (Col. #6) 1 120 Start with the theory behind the mathematics of amortization. . In completing an amortization schedule for a conventional mortgage, it is important to recognize the following: . The monthly payments are in amount. . The monthly payment is calculated by multiplying the mortgage's interest rate by the loan's outstanding balance. "The amount used to repay the loan's principal is calculated as the difference between the monthly payment amount and the monthly interest amount. It is over the life of the loan. . The ending balance for a particular month is calculated by subtracting the month's payment from the month's beginning balance. . Therefore, as the loan is repaid, the amount of interest owed , and the amount of principal repaid by each payment 3. The term refers to the dollar value of a home in excess of the amount owed on it. For example, a home that is worth, or has a market value of, $200,000 currently has a $165,000 mortgage loan against The house's owner currently has of equity in his or her home. Further, when the market value of the home is greater than the loan on it, the homeowner's equity is , but in market conditions in which the tomeowner owes more on the home than the house is worth, then the homeowner will have equity. This is also referred to as being in the value of the home. 4. As the loan is repaid, the homeowner's equity . The second source of homeowner's equity is: The depreciation in the market value of the home O The appreciation in the market value of the home2. The market for semiskilled labor can be represented by the following supply and demand curves: LD=32000 - 4000W LS =-8000 + 6000W, where L = millions of person hours per year, and W =the wage in dollars per hour. a. Calculate the equilibrium price and quantity that would exist under a free market. What impact does a minimum wage of $3.35 per hour have on the market? b. The government is contemplating an increase in the minimum wage to $5.00 per hour. Calculate the impact of the new minimum wage on the quantity of labor supplied and demanded. c. Calculate producer surplus (laborers' surplus) before and after the proposed change. Comment on the net effect of the proposed change upon workers as a whole and on individual workers. How does this price floor differ from an agricultural support price? d. Is the policy efficient from an economist's viewpoint