Question: Solve the following problems A. TERMINOLOGIES 1. Differentiate oligopoly from monopoly. Cite example for each. [5] 2. Draw the demand-and-supply curve and explain using example.

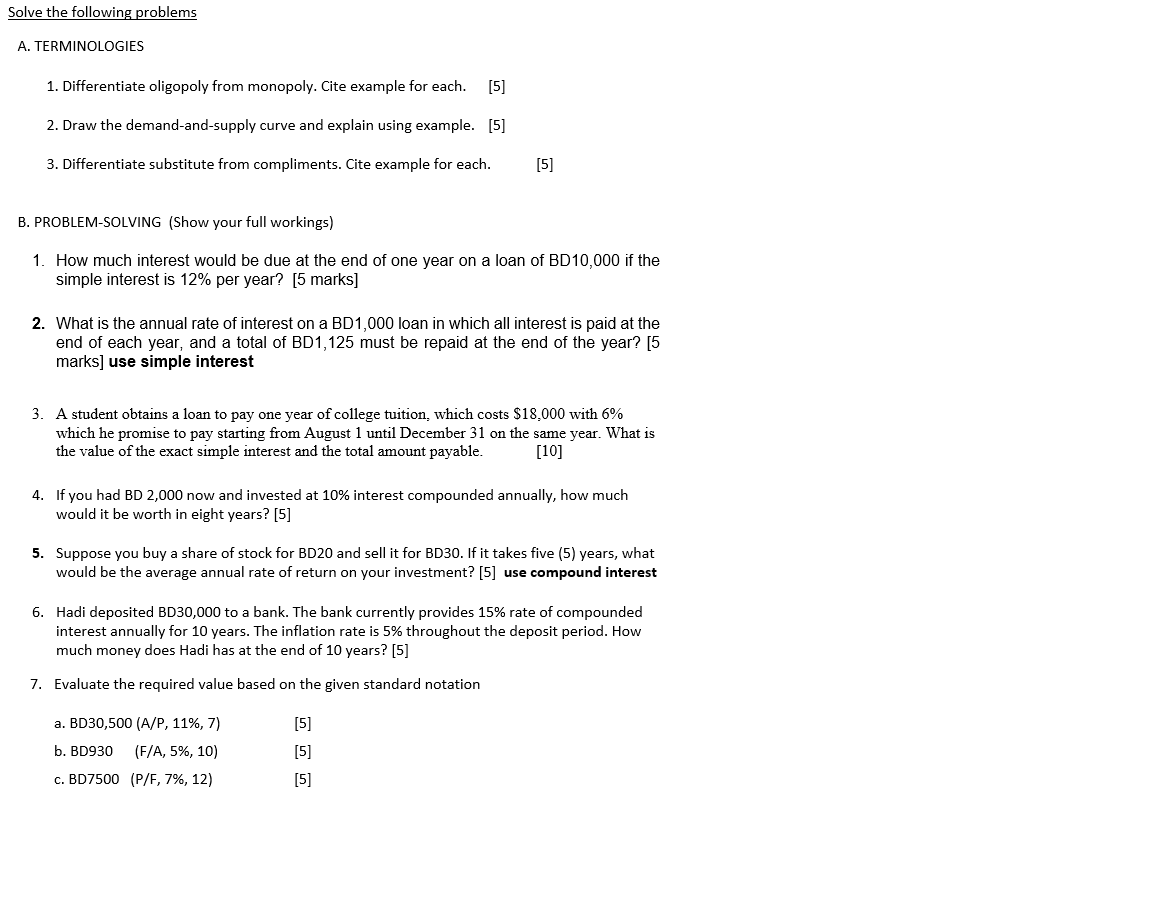

Solve the following problems A. TERMINOLOGIES 1. Differentiate oligopoly from monopoly. Cite example for each. [5] 2. Draw the demand-and-supply curve and explain using example. [5] 3. Differentiate substitute from compliments. Cite example for each. [5] B. PROBLEM-SOLVING (Show your full workings) 1. How much interest would be due at the end of one year on a loan of BD10,000 if the simple interest is 12% per year? [5 marks] 2. What is the annual rate of interest on a BD1,000 loan in which all interest is paid at the end of each year, and a total of BD1,125 must be repaid at the end of the year? [5 marks] use simple interest 3. A student obtains a loan to pay one year of college tuition, which costs $18.000 with 6% which he promise to pay starting from August 1 until December 31 on the same year. What is the value of the exact simple interest and the total amount payable. [10] 4. If you had BD 2,000 now and invested at 10% interest compounded annually, how much would it be worth in eight years? [5] 5. Suppose you buy a share of stock for BD20 and sell it for BD30. If it takes five (5) years, what would be the average annual rate of return on your investment? [5] use compound interest 6. Hadi deposited BD30,000 to a bank. The bank currently provides 15% rate of compounded interest annually for 10 years. The inflation rate is 5% throughout the deposit period. How much money does Hadi has at the end of 10 years? [5] 7. Evaluate the required value based on the given standard notation a. BD30,500 (A/P, 11%, 7) b. BD930 (F/A, 5%, 10) c. BD7500 (P/F, 7%, 12) [5] [5] [5]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts