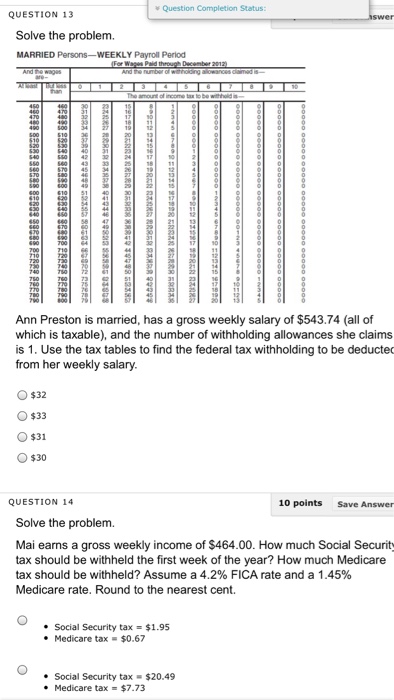

Question: Solve the problem. Ann Preston is married, has a gross weekly salary of $543.74 (all of which is taxable), and the number of withholding allowances

Solve the problem. Ann Preston is married, has a gross weekly salary of $543.74 (all of which is taxable), and the number of withholding allowances she claims is 1. Use the tax tables to find the federal tax withholding to be deducted from her weekly salary. $32 $33 $31 $30 Solve the problem. Mai earns a gross weekly income of $464.00. How mu Ch Social Security tax should be withheld the first week of the year? How mu Ch Medicare tax should be withheld? Assume a 4.2% FICA rate and a 1.45% Medicare rate. Round to the nearest cent. Social Security tax = $1.95 Medicare tax = $0.67 Social Security tax = $20.49 Medicare tax = $7.73 Solve the problem. Ann Preston is married, has a gross weekly salary of $543.74 (all of which is taxable), and the number of withholding allowances she claims is 1. Use the tax tables to find the federal tax withholding to be deducted from her weekly salary. $32 $33 $31 $30 Solve the problem. Mai earns a gross weekly income of $464.00. How mu Ch Social Security tax should be withheld the first week of the year? How mu Ch Medicare tax should be withheld? Assume a 4.2% FICA rate and a 1.45% Medicare rate. Round to the nearest cent. Social Security tax = $1.95 Medicare tax = $0.67 Social Security tax = $20.49 Medicare tax = $7.73

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts