Question: solve the problem Q No 1 answer the following questions draw graphs where asked [10 marks] 1. Explain CAPM model with the help of SML

solve the problem

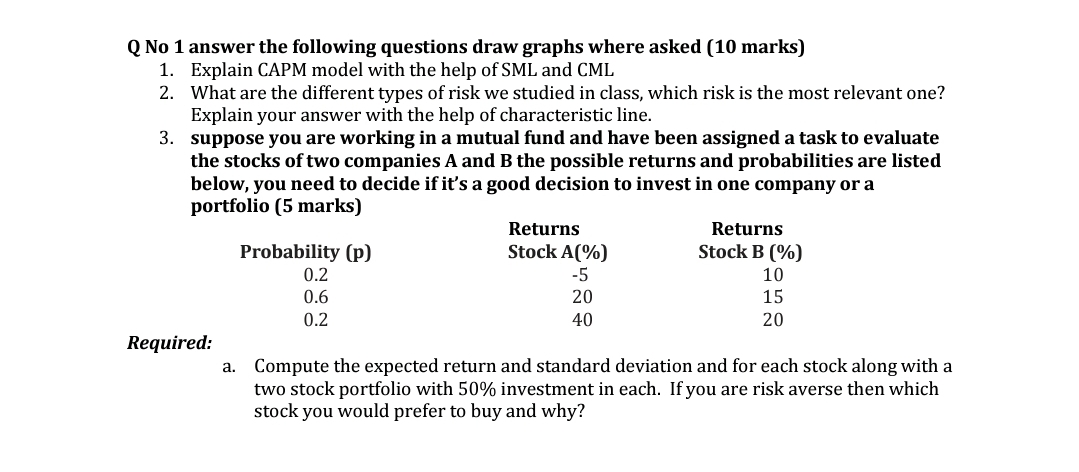

Q No 1 answer the following questions draw graphs where asked [10 marks] 1. Explain CAPM model with the help of SML and CML 2. What are the different types of risk we studied in class, which risk is the most relevant one? Explain your answer with the help of characteristic line. 3. suppose you are working in a mutual fund and have been assigned a task to evaluate the stocks of two companies A and B the possible returns and probabilities are listed below, you need to decide if it's a good decision to invest in one company or a portfolio (5 marks) Returns Returns Probability [p] Stock A(%) Stock B [%] 0.2 -5 10 0.6 2 U 1 5 0.2 40 20 Required: a. Compute the expected return and standard deviation and for each stock along with a two stock portfolio with 50% investment in each. If you are risk averse then which stock you would prefer to buy and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts